Commercial Health Plans: Specialty Medication Management and Market Access

Highlights of the report:

Download a PDF of these Highlights

The market environment for specialty drugs continues to be lively, with 2025 marked by increased competition, biosimilars activity, IRA questions, and a growing list of novel high cost treatments. HIRC’s report, Commercial Health Plans: Specialty Medication Management and Market Access, examines plans' evolving management tactics across 14 high profile specialty therapeutic areas and their top priorities for 2025. The report addresses the following questions:

- What are commercial plans' top activities to better manage the cost and utilization of specialty drugs in 2025? Which therapeutic areas are highest priority for management?

- How are plans modifying their formularies for specialty drugs?

- How are plans' utilization management tactics evolving?

- What is the status of benefit design programs such as accumulators, maximizers, and alternative funding programs?

- What is the current status of biosimilars adoption and enforcement? How is commercial health plan adoption of HUMIRA biosimilars evolving?

- What are plans doing to better manage drugs covered under the medical benefit?

- How are plans optimizing their specialty pharmacy provider networks?

Key Finding: Commercial plans continue to refine biosimilars strategies in 2025 in addition to tailoring the ideal mix of UM and formulary tactics as appropriate to each therapeutic class.

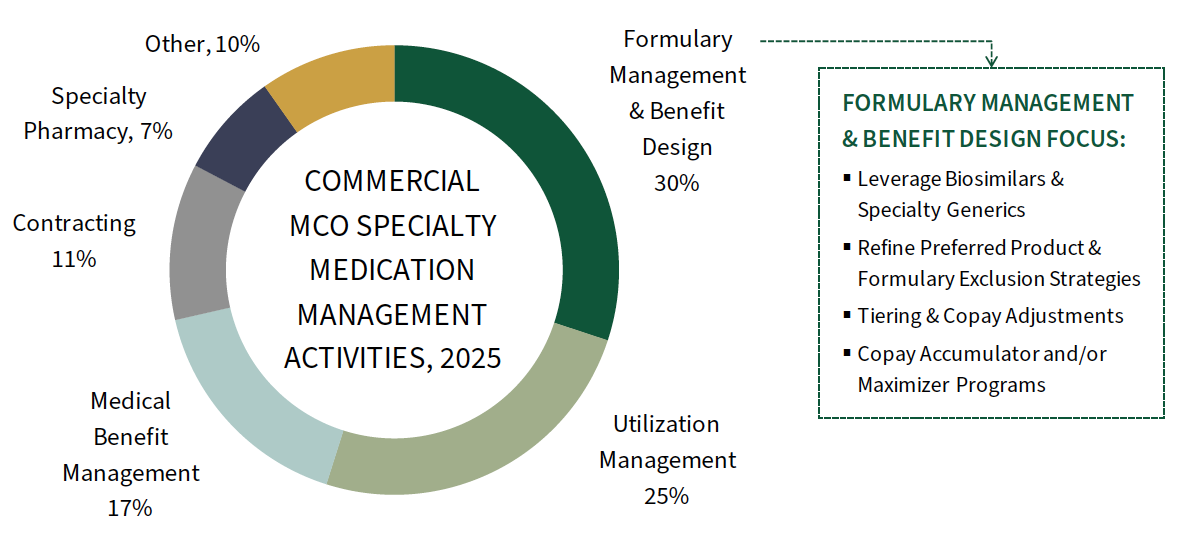

Plans Looking to Biosimilars and Prior Authorization Strategies to Help with Cost Savings in 2025. Commercial health plans were asked what their organization is most focused on in 2025 to better manage the cost and utilization of specialty pharmaceuticals. Plans' activities are most often centered in formulary management, benefit design, and traditional utilization management tactics. When it comes to formulary, plans are working to refine biosimilars and preferred product strategies, leveraging formulary exclusions where possible.

The complete report examines plans management trends across all of these topics in detail.

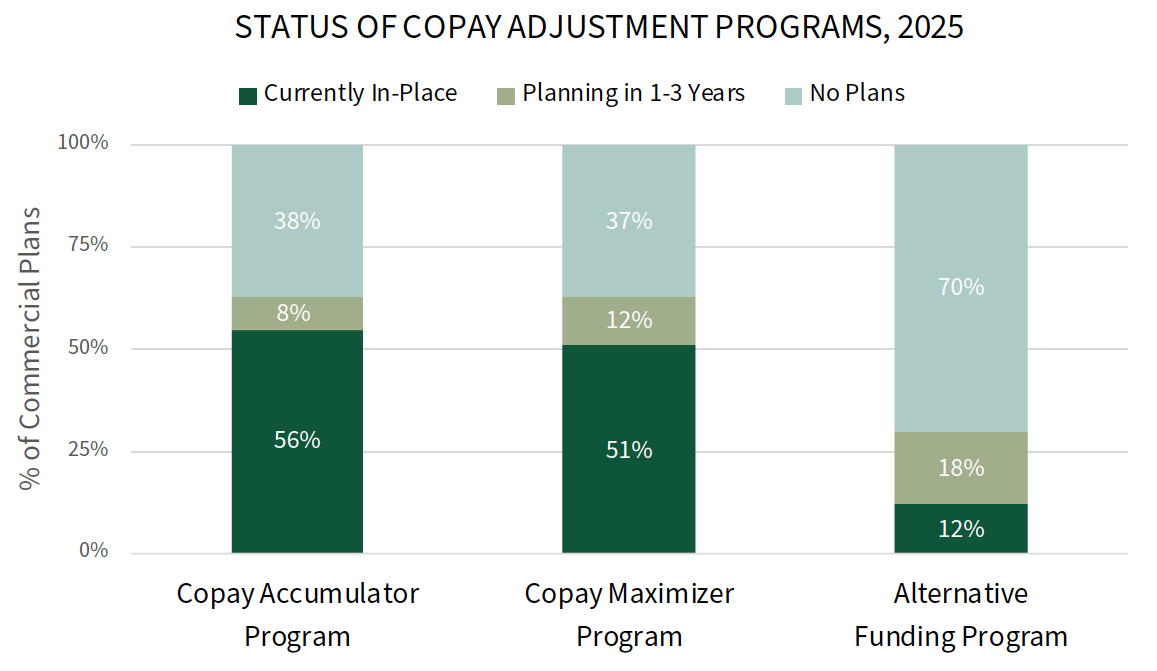

Status of Copay Adjustment Programs. Accumulator and maximizer programs swiftly entered the mainstream of the many benefit design tactics commercial health plans engage in; however, copay adjustment programs, accumulators in particular, have undergone various regulatory headwinds at the state and federal level. While roughly half of plans continue to maintain their copay accumulator and maximer offerings, follow-up interviews suggest that payer enthusiasm for these programs may be waning.

In additional to regulatory headwinds, manufacturers have pushed back by changing the terms of their patient assistance programs, at times making patients who are apart of a plan with an accumulator, maximizer or AFP ineligible for support. The complete report reviews these topics in detail.

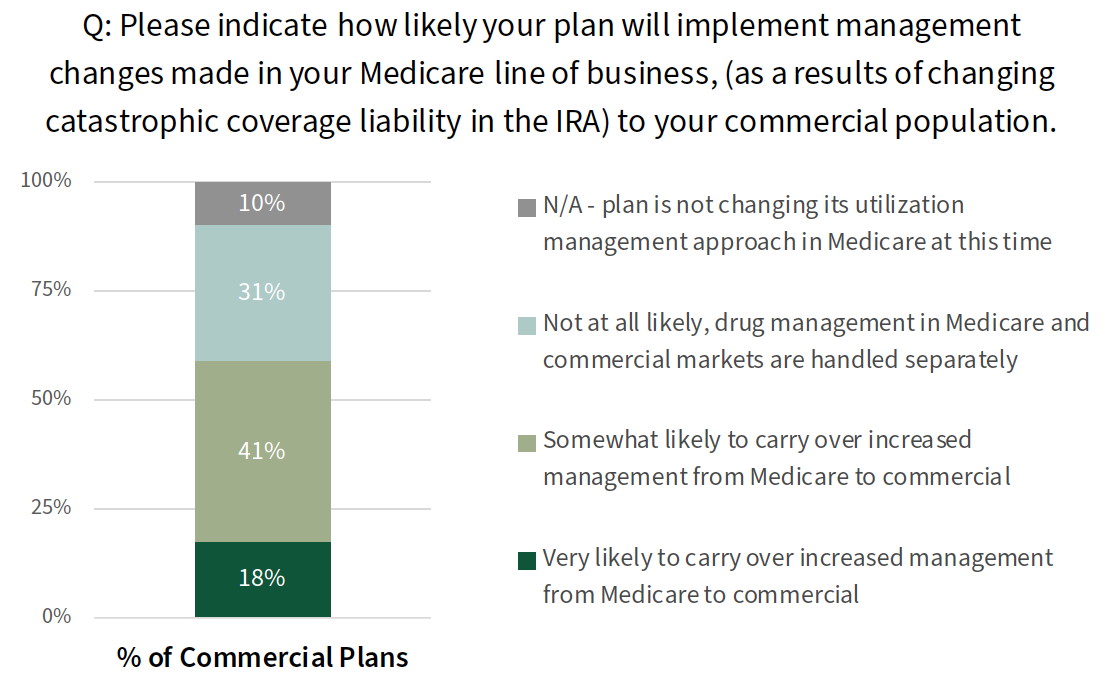

2025 Market Forces Making a Splash in Commercial: IRA Impact & Biosimilar Trends. Many unique market trends are poised to potentially impact the commercial market access environment in 2025. For example, though the Inflation Reduction Act applies to Medicare only, 59% of plans indicate that utilization management changes made on their Medicare line of business as a result of the change to catastrophic coverage liability would ‘Very Likely’ or ‘Somewhat Likely’ carry over to their management approach in commercial lines of business.

Additional market trends examined in the full include the potential impact of multiple low-cost STELARA biosimilars and PBMs' private-label biosimilar offerings.

Research Methodology and Report Availability. In January 2025, HIRC surveyed 51 pharmacy and medical directors from national, regional, and BCBS plans representing 122 million lives. Online surveys and follow-up telephone interviews were used to gather information. The Commercial Health Plans: Specialty Medication Management and Market Access report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >