April 2025. Examines PBMs involvement in specialty drug distribution, specialty medication management and formulary tactics, and trends in contracting with manufacturers.

Specialty Pharmaceuticals

2025 Research

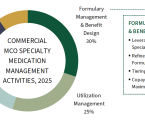

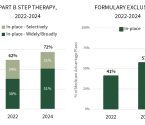

April 2025. Reviews plans' priorities in specialty drug cost containment for 2025 and examines activities in utilization management, medical benefit management, formulary and benefit design, and specialty pharmacy network optimization. Reviews the status of biosimilars uptake. Provides market access dashboards and management trends across 14 specialty therapeutic areas.

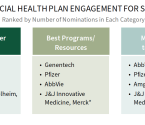

March 2025. Reviews health plan nominations of overall specialty manufacturer "Partner of Choice" and most valuable manufacturer-sponsored program/resource offerings for specialty. Benchmarks 35+ manufacturers in account support and willingness to contract for their specialty portfolios. Examines the evolving contracting environment across several specialty therapeutic classes and evaluates opportunities for partnership.

2024 Research

September 2024. Reviews MA plans' strategies to manage drug costs and utilization across several high profile specialty therapeutic classes, examines the contracting environment, and provides MA plan decision-makers evaluation of best-in-class manufacturer engagement.

June 2024. Provides an overview of specialty pharmaceutical spending and trends in distribution of specialty drugs. Examines recent notable SPP market activity and trends, and SPPs' most pressing strategic imperatives. Examines SPP service offerings for health plans and manufacturers. Provides profiles for the top industry-leading specialty pharmacy providers.

May 2024. Examines SPPs' manufacturer "Partner of Choice," manufacturer collaboration initiatives with SPPs, best-in-class account manager nominations, and and benchmark ratings of manufacturers in account support and willingness to contract. Examines the contracting environment across 12 specialty therapeutic classes.

-

PBMs continue to seek solutions to better manage the specialty drug trend as their clients demand relief from rising costs. HIRC’s report, Pharmacy Benefit Managers: Specialty Medication Management...

-

The market environment for specialty drugs continues to be lively, with 2025 marked by increased competition, biosimilars activity, IRA questions, and a growing list of novel high cost treatments....

-

MCO account engagement supporting manufacturers' specialty product portfolios is critical as the market landscape grows more competitive across a range of therapeutic classes. HIRC’s report,...

-

Medicare Advantage (MA) plans are expected to manage specialty pharmaceuticals more aggressively, especially as we move towards full implementation of the IRA. HIRC’s report, Medicare Advantage Plans...

-

The specialty pharmacy market is nothing short of dynamic as payers increase vertical integration, health systems enhance access, and regulatory activity continues to emerge and develop. HIRC’s...

-

Specialty pharmacy provider (SPP) partnerships can effectively shape the brand experience and enhance patient and market access. HIRC’s report, Specialty Pharmacy Providers: Manufacturer Engagement...

Specialty Pharmaceuticals

Research Overview

Payers remain focused on optimizing strategies to manage specialty drug cost and utilization as the drug spend continues to rise. HIRC's Specialty Pharmaceuticals Service assists pharmaceutical manufacturers in developing and maintaining successful market access strategies by monitoring trends in payers' specialty medication management initiatives, issues in channel distribution, and manufacturer engagement with key customers. HIRC utilizes a triangulated research design, combining primary survey data, interview insights, and in-depth secondary research, resulting in a deep understanding of issues related to specialty pharmaceutical market access.

Therapeutic Areas Covered:

- Alzheimer's Disease*

- Amyotrophic Lateral Sclerosis (ALS)*

- Cholesterol-lowering Biologics

- Chronic Kidney Disease*

- Erythropoiesis-stimulating Agents

- HIV/AIDS

- I&I – Dermatology

- I&I – Gastrointestinal

- I&I – Rheumatoid Arthritis

- Migraine

- Multiple Sclerosis

- MASH (formerly NASH)

- Ocular Disorders

- Parkinson's Disease

- Respiratory Biologics

- White Blood Cell Stimulants

*Select Market Segments

For more information or to subscribe, contact Danielle Snook via email or at (408) 884-8560

Covering the Specialty Market Ecosystem

The service monitors specialty drug management and manufacturer benchmarking and contracting trends across both Commerical and Medicare Advantage plan market segments. It also tracks trends and manufacturer engagement within the specialty pharmacy provider distribution channel.

- Commercial Health Plans: Management Trends, Manufacturer Benchmarking, & Contracting

- Pharmacy Benefit Managers: Management Trends & Contracting

- Specialty Pharmacy Providers: Channel Distribution Trends, Manufacturer Engagement, & Contracting

- Medicare Advantage Plans: Management Trends & Contracting

Bringing Value to Subscribers

HIRC's data and insights enable subscribers to understand and track market dynamics and trends critical to optimal product and value-added program positioning as the specialty market evolves. Through detailed analyses, key implications, and strategic recommendations from experienced HIRC researchers, subscribers to the Specialty Pharmaceuticals Service are able to understand the specialty market landscape, evaluate account support, identify specialty-specific managed care needs, and act upon partnership opportunities.