Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Assessment

Highlights of the report:

Download a PDF of these Highlights

Strong competitive positioning with commercial health plans is vital for pharmaceutical manufacturers to maintain market access and strengthen payer partnerships. HIRC's report, Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Assessment, reviews pharmacy and medical directors' evaluation of pharmaceutical firms and focuses on trends in contracting. The report addresses the following questions:

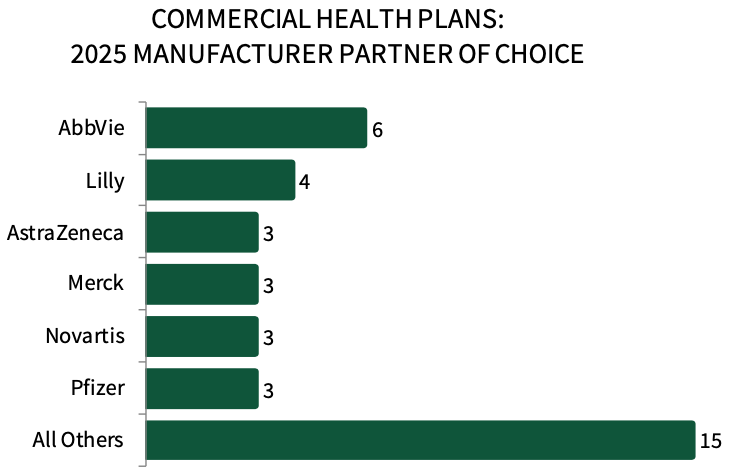

- Which manufacturers are most often nominated as plans' overall "Partner of Choice"?

- Which manufacturers do commercial health plans rate as most willing to contract? Which firms are most willing to contract for medications covered under the pharmacy and medical benefit?

- Which contract types are most frequently executed across therapeutic areas and what are the most common rebate/discount amounts offered? Which contracts are most valuable?

- How common are portfolio, indication, and risk-based contracts in the commercial segment and in which therapeutic areas are they observed?

Key Finding: Over 45% of HIRC's commercial health plan panel report having at least one portfolio-based contract in-place in 2025. Portfolio contracts are most commonly reported in respiratory diseases, inflammatory conditions, and diabetes/weight loss.

AbbVie Leads as Plans' Top Partner of Choice in 2025. AbbVie is most often nominated as commercial health plans' overall partner of choice in 2025, followed by Lilly, AstraZeneca, Merck, Novartis, and Pfizer. The primary factors driving nominations include a firm's willingness to contract and demonstrating an understanding of customers' business needs & bringing relevant resources.

The full report provides a complete listing of manufacturer partner of choice nominations in 2025 and examines the rationale for ratings in detail.

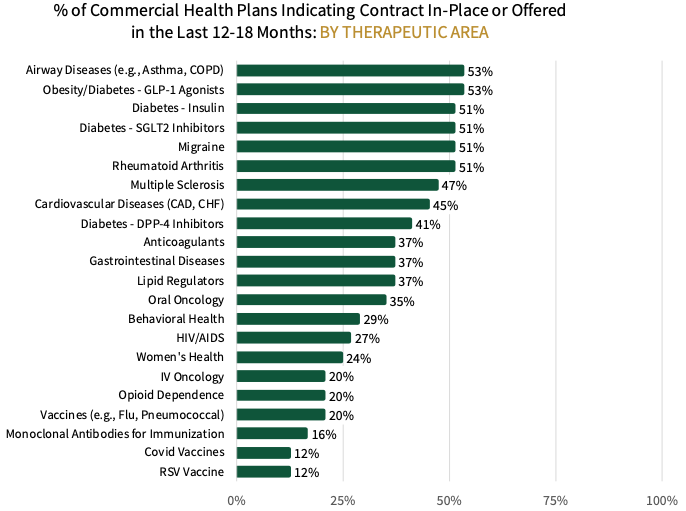

Commercial Health Plans Most Often Report Contracts in Airway Disease & Obesity/Diabetes - GLP-1 Agonists. Commercial health plan key decision-makers were asked to consider a list of 20+ therapeutic areas and indicate if their organization has a contract in-place or has been offered a contract in the past 12-18 months. Panelists most frequently report contracts for airway diseases and GLP-1 agonists (53% of plans), followed by diabetes insulin & SGLT2 inhibitors, migraine, and RA medications (51% of plans).

The full report provides an in-depth exploration of the commercial health plan contracting landscape in 2025, including contracting activity across therapeutic area, contract type, most common rebate/discount amounts, and status of alternative/novel contracting approaches.

Research Methodology and Report Availability. In December 2024 and January 2025, HIRC surveyed 49 commercial health plan pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Assessment, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >