Integrated Delivery Networks: Direct Contracting and Medication Management

Highlights of the report:

Download a PDF of these Highlights

Integrated Delivery Networks (IDNs) continue to engage in a number of activities that can impact pharmaceutical market access. HIRC's report, Integrated Delivery Networks: Direct Contracting and Medication Management, reviews the landscape of direct contracting between IDNs and pharmaceutical manufacturers and examines health systems' influence over physician prescribing behavior. The report addresses the following questions:

- What are the recent trends in IDNs' acquisition of pharmaceuticals? In what cases will IDNs seek to purchase medications directly from manufacturers rather than their GPO?

- What is the landscape of direct purchasing contracts between IDNs and manufacturers? Which therapeutic classes have the most direct contracting activity? What types of direct contracts are most common and what are the range of discount/ rebate amounts? Which manufacturers are most willing to offer direct contracts?

- What is the status of IDN pharmacy services, including the prevalence of IDN-owned specialty pharmacies?

- What medication management tactics do IDNs utilize and how are they enforced?

- What is the status of biosimilars adoption among IDNs?

Key Finding: In an effort to better control costs, IDNs are increasingly contracting directly with manufacturers for the acquisition of pharmaceuticals, as well as leveraging formularies and biosimilars.

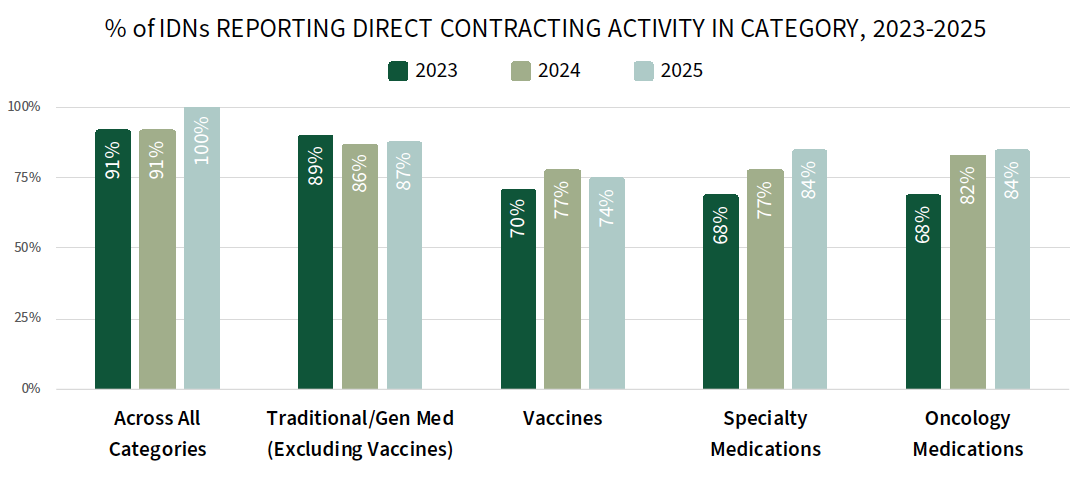

A Greater Share of IDNs Report Direct Contracting Activity with Manufacturers in 2025. While IDNs continue to source most of their pharmaceutical product from their affiliated group purchasing organizations (GPOs) and wholesalers, data suggest that IDNs are increasingly purchasing directly from manufacturers. Direct contracting between IDNs and manufacturers is gaining traction as health systems look to control costs, avoid disruptions, and manage shortages.

The complete report reviews the direct contracting landscape (prevalence, contract types/approaches, and discount amounts) for a listing of 30+ therapeutic areas.

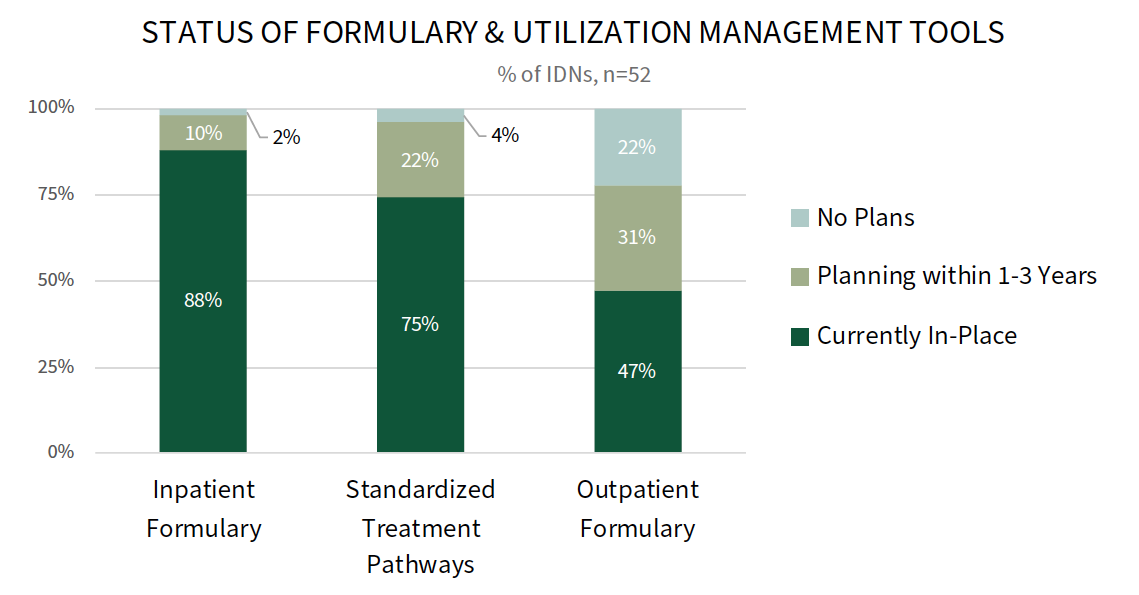

A Majority of IDNs Have an Inpatient Formulary & Standardized Treatment Pathways. IDNs use a number of levers and tools to manage medication costs and influence physician prescribing behavior. Most IDNs have an inpatient formulary (88%) and standardized treatment pathways (75%), and 47% report having an outpatient formulary.

Follow-up interviews reveal that some IDNs are considering developing or improving their outpatient formularies in the future, with a focus on flexibility and alignment with payer requirements. To enforce the use of formularies and pathways, IDNs embed order sets and best practice alerts into the electronic medical record. IDNs will also monitor prescribing patterns and follow-up with provider education to encourage compliance.

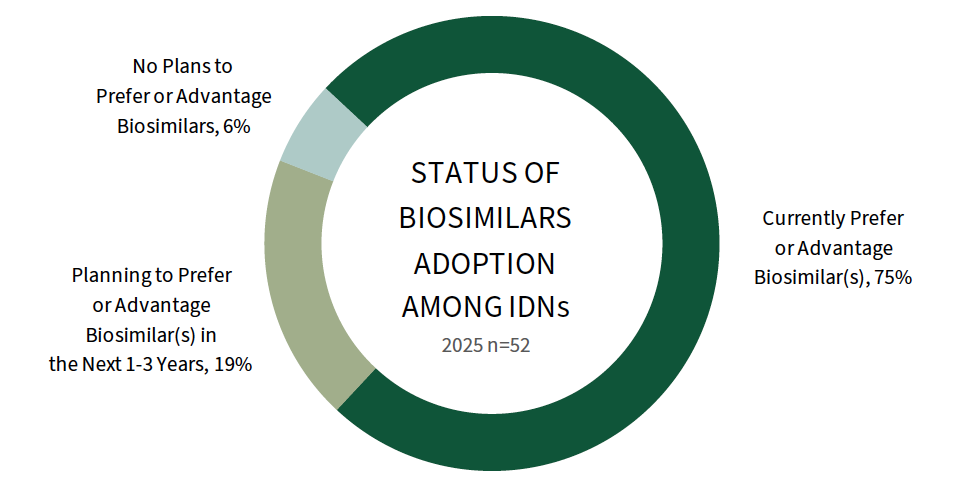

Most of IDNs Prefer at Least One Biosimilar. Three quarters of IDNs (75%) report preferring at least one biosimilar in their 2025 formularies. Biosimilars adoption varies by therapeutic area, with a higher percentage of IDNs reporting preferences for REMICADE, NEUPOGEN, and RITUXAN biosimilars. The full report explores biosimilar enforcement and the direct contracting landscape for biosimilars and reference brands.

Research Methodology and Report Availability. In December and January, HIRC surveyed 52 IDN pharmacy directors, medical directors, and senior leaders. Online surveys and follow-up telephone interviews were used to gather information. The full report, Integrated Delivery Networks: Direct Contracting and Medication Management, is part of the Organized Providers Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >