Integrated Delivery Networks: Manufacturer Account Engagement and Competitive Positioning

Highlights of the report:

Download a PDF of these Highlights

Engagement with integrated delivery networks (IDNs) is an important component of manufacturers' market access strategies, as these systems often maintain a high control over physician prescribing behavior. HIRC's report, Integrated Delivery Networks: Manufacturer Account Engagement and Competitive Positioning, reviews manufacturer presence with IDN accounts as well as IDNs' Partners of Choice and relational status ratings. The report addresses the following questions:

- What level of access do key pharmaceutical manufacturer personnel types (e.g., account manager, sales rep, MCSL) have to IDN decision-makers?

- Which pharmaceutical manufacturers have the highest presence with IDN accounts?

- Which manufacturers do IDN decision-makers select as their overall "Partner of Choice"? What key factors drive panelist selections?

- How do IDNs rate their relational status with 35+ manufacturers, from distant/tactical to collaborative/strategic?

- How can manufacturers drive towards more collaborative or strategic relationships with IDNs?

Key Finding: To foster more collaborative & strategic partnerships, IDN decision-makers recommend building trust and sincerity, offering flexible and customizable resources, and proactively coming prepared with knowledge of the account and its needs.

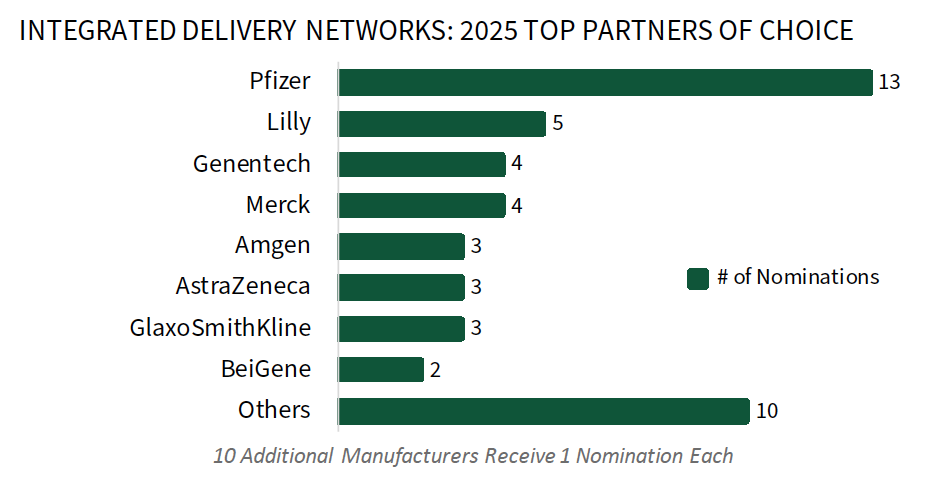

Pfizer Retains its Position as the Clear Manufacturer “Partner of Choice” Among IDN Decision-makers. IDN decision-makers were asked to nominate a single pharmaceutical manufacturer as their overall Partner of Choice. Pfizer is the clear leader with 13 nominations, maintaining its leadership position for the last 3+ years. IDNs recognize Pfizer’s tenured account management personnel who proactively and collaboratively work with IDNs to ensure product access and offer contracting opportunities.

Lilly, Genentech, and Merck round out IDNs' top Partners of Choice for 2025. The complete report reviews the full list of manufacturers nominated as Partner of Choice and the critical factors driving panelists' nominations.

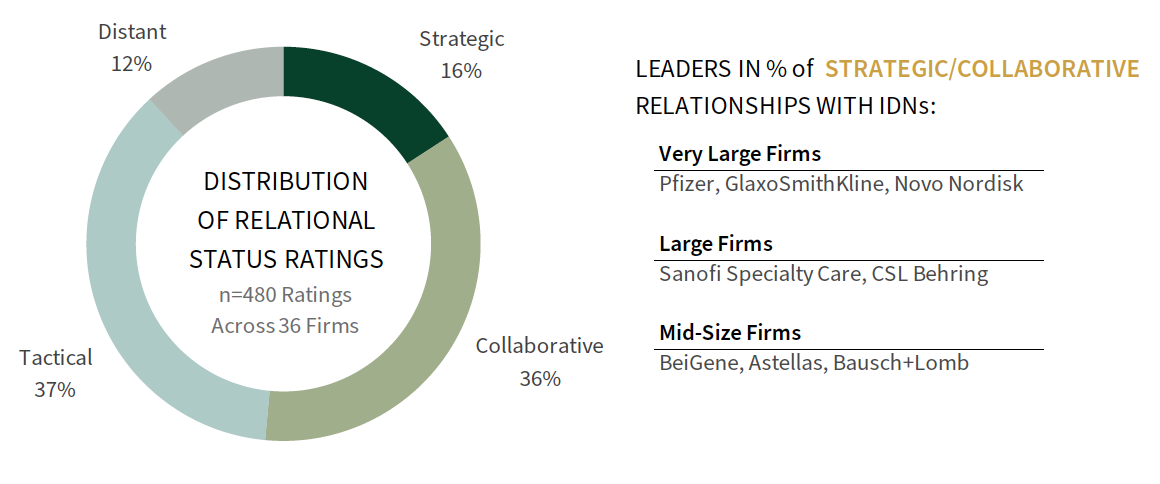

Relational Status Ratings for 35+ Manufacturers. IDN executives were asked to consider and rate pharmaceutical manufacturers based on their relational status from distant, tactical, collaborative, to strategic. Overall, IDN key decision-makers rate 16% of relationships as strategic, 36% as collaborative, 37% as tactical, and the remaining 12% as distant.

Pfizer leads the Very Large size cohort in its percentage of strategic and collaborative relationships with IDNs, followed by GlaxoSmithKline and Novo Nordisk. Sanofi Specialty Care and CSL Behring lead the Large firm cohort, and BeiGene, Astellas, and Bausch+Lomb lead among Mid-size firms. The full report provides ratings for a listing of 35+ manufacturers.

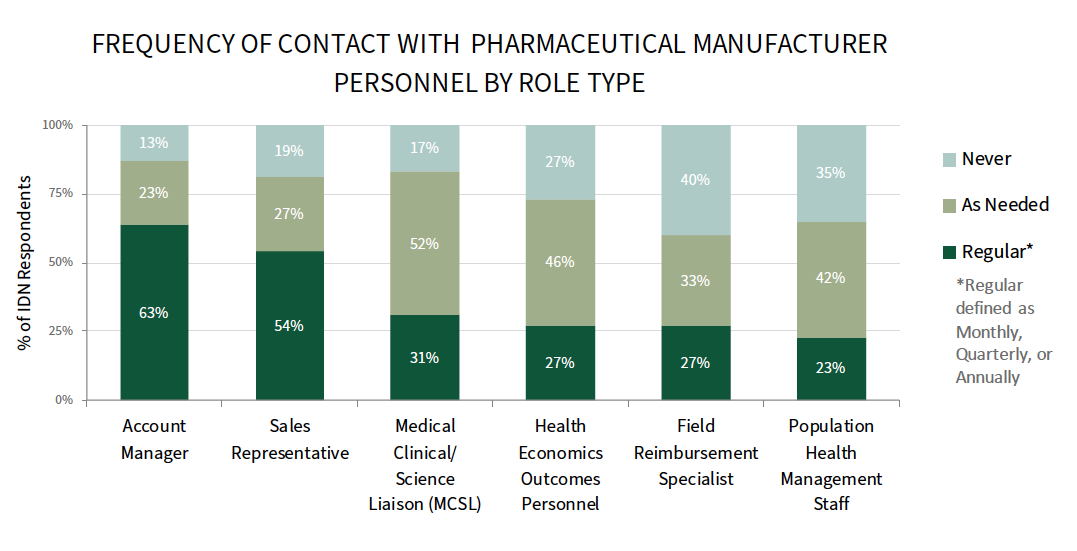

Key Account Managers Have Greatest "Regular" Access to IDN Decision-Makers. IDN executives report that they most frequently interact with pharmaceutical manufacturer account managers and sales representatives on a regular basis (monthly, quarterly, or annually), while technical personnel (MCSLs, FRMs, HEOR, population health roles) are most often seen on an “as needed” basis.

Research Methodology and Report Availability. In December and January, HIRC surveyed 52 IDN pharmacy directors and senior leaders. Online surveys and follow-up telephone interviews were used to gather information. The full report, Integrated Delivery Networks: Manufacturer Account Engagement and Competitive Positioning is part of the Organized Providers Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >