Managed Markets Headcount & Organization Study 2024/2025

Highlights of the report:

Download a PDF of these Highlights

Pharmaceutical manufacturers continue to evolve managed markets staffing structures to meet customer needs as the market landscape changes due to continued consolidation and government policy changes. HIRC's report, Managed Markets Headcount and Organization Study, assists pharmaceutical manufacturers in understanding trends in headcount across very large, large, and mid-size firms. Select key findings include:

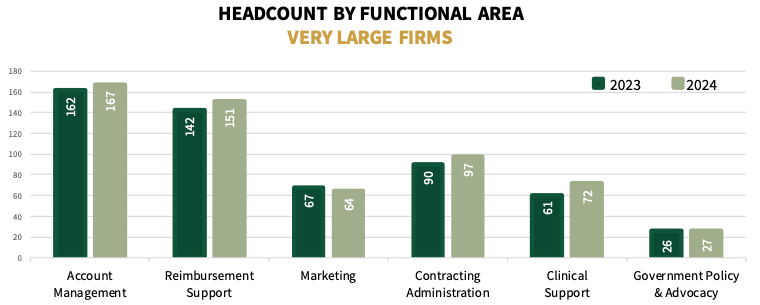

- Headcount across very large firms increased overall year-over-year due to growth in all functional areas in 2024.

- Account Management represents the largest portion of pharmaceutical manufacturer headcount and is comprised mainly of account managers covering organized provider accounts (43%), payer accounts (39%), and distribution channel accounts (18%).

- Clinical Support headcount increased by 10%, namely due to increases across Medical Science Liaison and HEOR/Outcomes Research/CER headcount.

Key Finding: Government Policy & Regulations account for about 42% of market trends with potential to limit access identified by pharmaceutical firms in 2024, followed by Utilization Management & Formulary Controls (18%), and Contracting (17%).

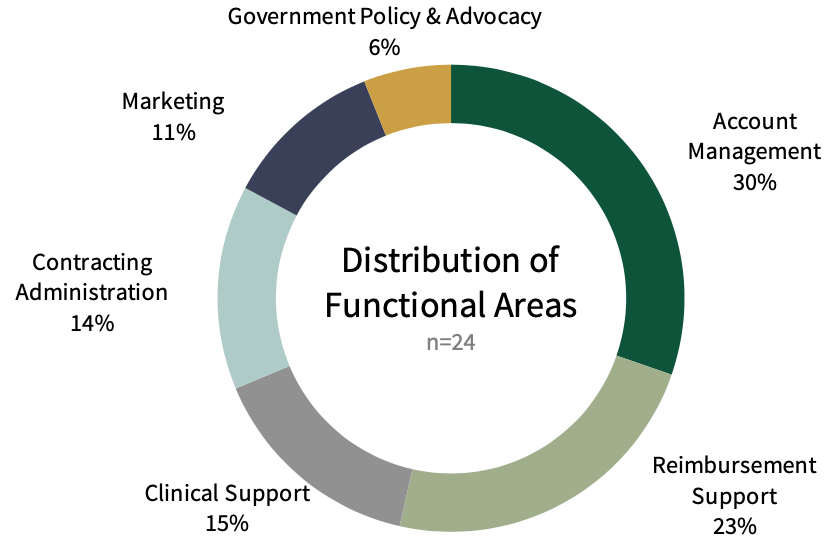

Account Management and Reimbursement Staff Comprise Over Half of the Typical Managed Markets Organization. Pharmaceutical managed markets organizations are comprised mostly of Account Management and Reimbursement Support staff, together accounting for 53% of total managed markets personnel, followed by Clinical Support (15%), Contracting Administration (14%), Marketing (11%), and Government Policy & Advocacy (6%).

Very Large Pharmaceutical Firms' Experience 5% Increase in Total Headcount Year-Over-Year. Very large pharmaceutical manufacturers (>$18B U.S. Sales) increased from about 547 full time employees (FTEs) in 2023, to about 577 FTEs in 2024, or about a 5% increase year-over-year. Increases in very large firm headcount are observed in Clinical Support (+19%), followed by Contracting Administration (+8%), Reimbursement Support (+6%), Account Management (+3%), and Government Policy & Advocacy (+3%), while Marketing headcount decreased by about -3% in 2024.

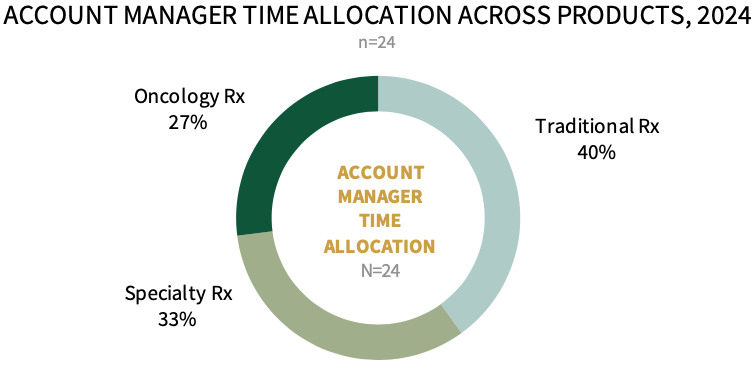

Account Manager Allocation Across Medication Type, 2024. Panelists were asked to estimate Account Manager allocation across traditional, specialty, and oncology medications. In 2024, respondents indicate that about 40% of AM headcount are allocated to traditional medications, followed by 33% focusing on specialty pharmaceuticals, and 27% dedicated to oncology products. Additionally, very large firms report the highest percentage of AMs dedicated to oncology agents, while large firms report the highest percentage of AMs dedicated to traditional products.

Research Methodology and Report Availability. HIRC surveyed leading pharmaceutical companies during fall 2024 to gain insights concerning their managed markets headcount, organizational structures, and the key issues driving their staffing investments. Each company’s data are privacy-protected, and results are only reported in aggregate to ensure confidentiality. The complete report, Managed Markets Headcount and Organization Study, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >