Market Access and Partnership Landscape: Key PBM-Owned GPO Accounts

Highlights of the report:

Download a PDF of these Highlights

Vertical integration between Plans, PBMs, GPOs, Specialty Pharmacies, and Providers continues to challenge pharmaceutical manufacturer access and partnership opportunities. An understanding of the access and partnership landscape for key accounts is critical for effective account planning and strategy development. HIRC's report, Market Access and Partnership Landscape, provides manufacturer ratings of select customers' ability to limit brand access and willingness to partner. The report addresses the following questions:

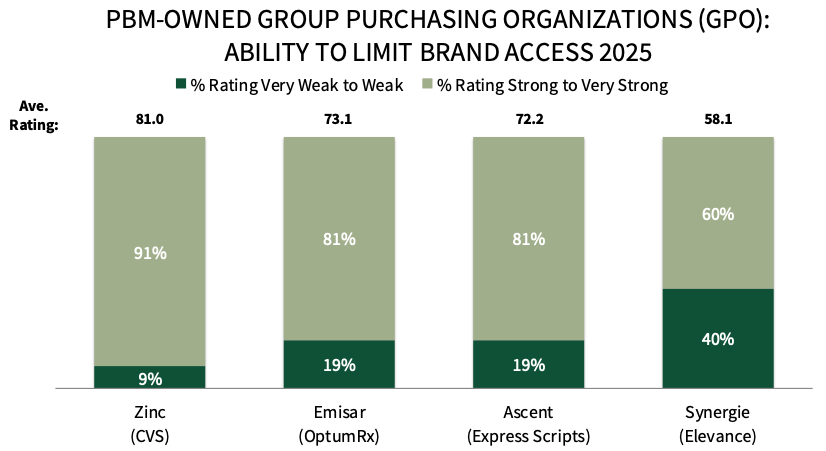

- Which PBM-owned GPO accounts are rated by manufacturers as most able to limit brand access? Why?

- Which PBM-owned GPO accounts are rated by manufacturers as most willing to partner? Why?

- What are the key characteristics of PBM-owned GPOs with a strong ability to limit brand access?

- What are the key characteristics of PBM-owned GPOs that are the most willing to partner?

Key Finding: Firms with the strongest ability to limit brand access are typically characterized by their size and ability to impact market share/contracting power, vertical integration, strong UM & formulary control, and expanded use of excluded or preferred drug lists.

Zinc Leads with Highest Ability to Limit Brand Access in the PBM-Owned GPO Segment. Managed markets respondents from leading pharmaceutical firms rate Zinc (CVS Caremark) highest in ability to limit brand access in the PBM-owned GPO segment, with panelists noting their size and client network, as well as their consolidation and vertical integration of retail, mail, specialty pharmacy, and group purchasing organization entities.

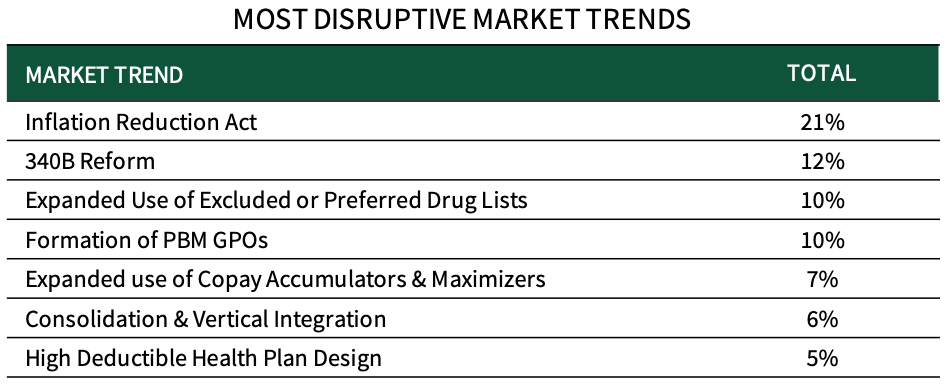

Panelists Identify the Inflation Reduction 340B Reform as Top Market Trends in 2025. Managed markets respondents from leading pharmaceutical firms were asked to list the top market trends/disruptors with the highest potential to limit access to customers. Respondents identify the Inflation Reduction Act followed as the top market trend for the third year in a row. Secondary trends include 340B reform, expanded use of excluded or preferred drug lists, formation of PBM-owned GPOs, and expanded use of copay accumulators and copay maximizers. The full report includes a complete listing of pharmaceutical firms' most disruptive market trends in 2025.

The full report, Market Access and Partnership Landscape, provides manufacturer ratings of customers' ability to limit brand access and willingness to partner, as well as the factors driving ratings across the following key channels:

- Pharmacy Benefit Managers (PBMs)

- PBM-Owned Group Purchasing Organizations (GPOs)

- Managed Care Ogranizations (MCOs)

- Medical Benefits Managers

Research Methodology and Report Availability. In January, HIRC surveyed 107 respondents at 38 pharmaceutical firms. Online surveys were used to gather quantitative and qualitative information. The complete report, Market Access and Partnership Landscape, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >