Market: Medicare (Spring 2015)

Highlights of the report:

Download a PDF of these Highlights

Merck, Novo Nordisk and AstraZeneca are Leaders in the Medicare Market

Merck, Novo Nordisk and AstraZeneca top Medicare executives’ lists for companies that are most willing to negotiate contracts and those that provide the greatest value in resources.

- When contracting and resource ratings are combined, Merck is #1, followed by Novo Nordisk in 2nd place and AstraZeneca in 3rd.

- Medicare plan executives also rate Merck highest for the value of its resources.

- Merck’s commitment to aligning its resources with the Medicare plan’s priorities and patients’ needs is key to its leadership in the Medicare market.

“Merck has just consistently been a company that understands our line of business, understands the resources that might be needed, will provide resources that are tailored to the older population. They will even get into the scripting about how best to talk with patients.”

- Medicare plan executives rate Novartis #1 for willingness to negotiate contracts.

- Novartis’ willingness to contract for oncology products is highly valued by Medicare plans.

“We have two oncology products contracted right now, that being Gleevec and Tasigna for CML, both by Novartis Oncology.”

Merck is the leading Partner of Choice for Medicare plans and successfully establishes strategic relationships with key Medicare customers. Novo Nordisk and GSK are also valued partners for Medicare plans as both companies perform well in HIRC’s partnering metrics.

Key Finding: Medicare plans praise Merck, Novo Nordisk and AstraZeneca for their contracting and value-added resources.

Medicare Plans’ Closed Formularies are Driving Manufacturers’ Aggressive Rebates as they Strive to Ensure Access

Access contracts are continuing to gain traction as Medicare plans use closed formularies to manage costs and drug utilization. Some Medicare plans are implementing access contracts with restrictions to further differentiate between multiple products in a non-preferred tier.

“We are seeing an increased number of manufacturers that are willing to contract for tier three – it’s probably increased by 50%. We’re also seeing a lot more tier-three options, and that’s because it’s a closed formulary and they’d rather have coverage at tier-three versus not covered at all.”

“Manufacturers are now definitely more willing to look at contracting for sort of a preferred position in that non-preferred tier. If there are four drugs that are non-preferred, how do I get preferential treatment if I’m in there?”

“If anything, manufacturers are more interested in access, so they may be willing to adjust the rebate level for fewer prior auths, fewer steps; that’s certainly a trend.”

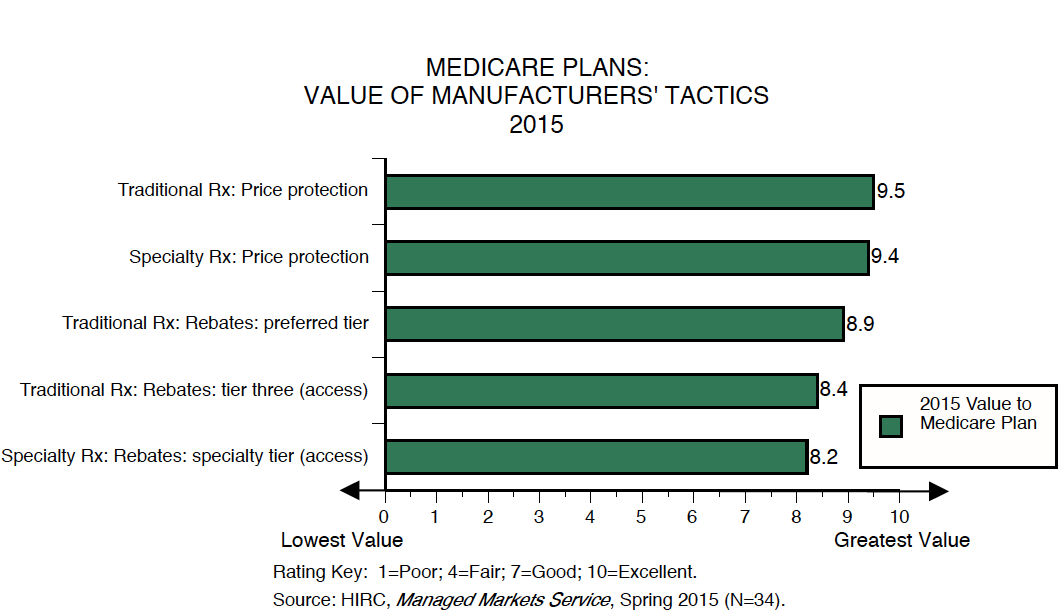

In addition, when asked to rate the relative value provided by a range of pharmaceutical companies’ contracting tactics and value-added resources, Medicare plan executives rate the following three contracting terms highest in value:

- Traditional Rx: Price Protection

- Specialty Rx: Price Protection

- Traditional Rx: Rebates—Preferred Tier

These terms are valued by Medicare plans because they address many of their budgeting challenges and key factors fueling escalating costs.

Research Methodology and Report Availability

HIRC's benchmarking research was conducted in the first quarter of 2015 through a combination of more than 140 surveys and 55 in-depth interviews with decision makers in four Commercial and three Government managed markets. The full report, Medicare Plans, is available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >