Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Positioning

Highlights of the report:

Download a PDF of these Highlights

As the industry evolves towards value-based care, an innovative contracting strategy in combination with program/resource offerings for managed care plans is critical to maintaining market access. HIRC's report, Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Positioning, reviews health plan pharmacy and medical directors' evaluation of manufacturers and focuses on trends in contracting. The report addresses the following:

- Which manufacturers are rated as most willing to contract by commercial health plan decision-makers?

- What level of rebates/discounts are manufacturers offering for formulary access across therapeutic areas?

- Which contract types are most commonly offered? What are the challenges and advantages of having risk/outcomes-based contracts in place with manufacturers?

- Which manufacturers are most often nominated as plans' overall "Partner of Choice"?

- What types of programs and/or resources are commercial plans most interested in?

Key Finding: While risk/outcomes-based contracts are rarely available, panelists report high interest in outcomes-based agreements due to savings and clinical validation of medications.

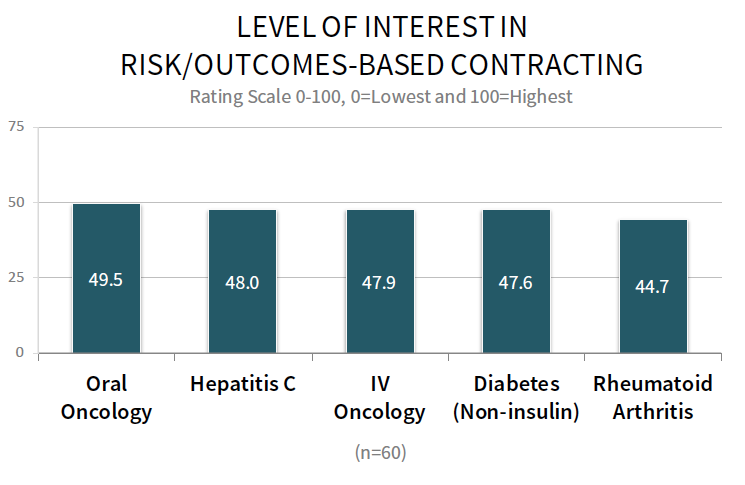

Commercial Respondents Report Highest Interest in Risk/Outcomes-based Contracting for Oral Oncology & Hepatitis C. Respondents were asked to consider and rate their level of interest in risk/outcomes-based contract engagement across therapeutic areas. Commercial health plans report the highest interest in risk/outcomes-based contracting for high cost oncology and specialty medications (oral oncology, hepatitis C, IV oncology, and rheumatoid arthritis) as well as high volume traditional medications, such as diabetes.

The full report provides a complete listing of interest in risk/outcomes-based contracting across 13 therapeutic areas.

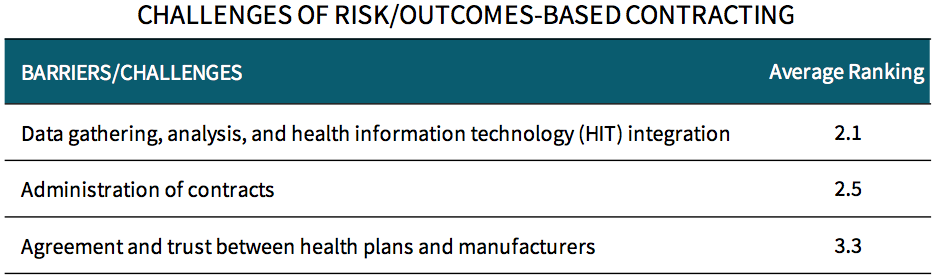

Data Gathering, Analysis and HIT Integration Among Top Challenges of Risk/Outcomes-based Contracting. When asked to rank order the top challenges of implementing and executing risk/outcomes-based contracting, commercial health plan respondents identify data gathering, analysis, and health information technology (HIT) integration as the primary challenge, followed by administration of the contracts, and agreement/trust between health plans and manufacturers.

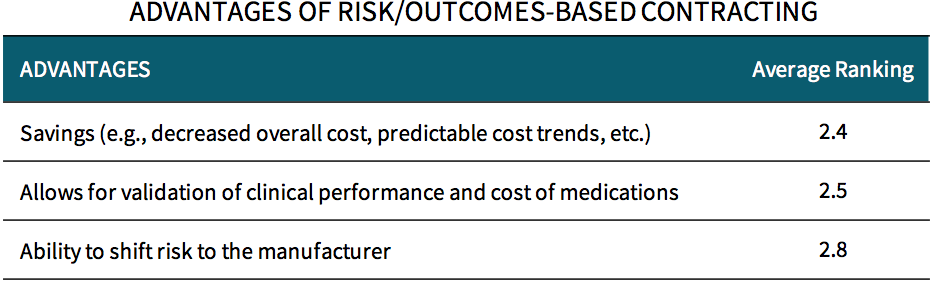

Savings and Clinical Validation of Medications Among Top Advantages of Risk/Outcomes-based Contracting. When asked to rank order the top advantages of risk/outcomes-based contracting, commercial health plan respondents identify savings (e.g., decreased overall cost, predictable cost trends, etc.) as the primary advantage, followed by allowing for validation of clinical performance and cost of medications, and ability to shift risk to the manufacturer.

Research Methodology and Report Availability. In December 2018 and January 2019, HIRC surveyed 60 commercial health plan pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Contracting Landscape and Manufacturer Competitive Positioning, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >