Integrated Delivery Networks: Profiles of Industry-leading IDNs and the Access & Partnership Landscape

Highlights of the report:

Download a PDF of these Highlights

Effective engagement with integrated delivery network (IDN) accounts is imperative as these organizations' role in the market access landscape continues to increase. HIRC's report, Integrated Delivery Networks: Profiles of Industry-leading IDNs and the Market Access & Partnership Landscape, provides manufacturers with key resources to assist in account planning for select industry-leading integrated delivery network accounts. The following questions are addressed:

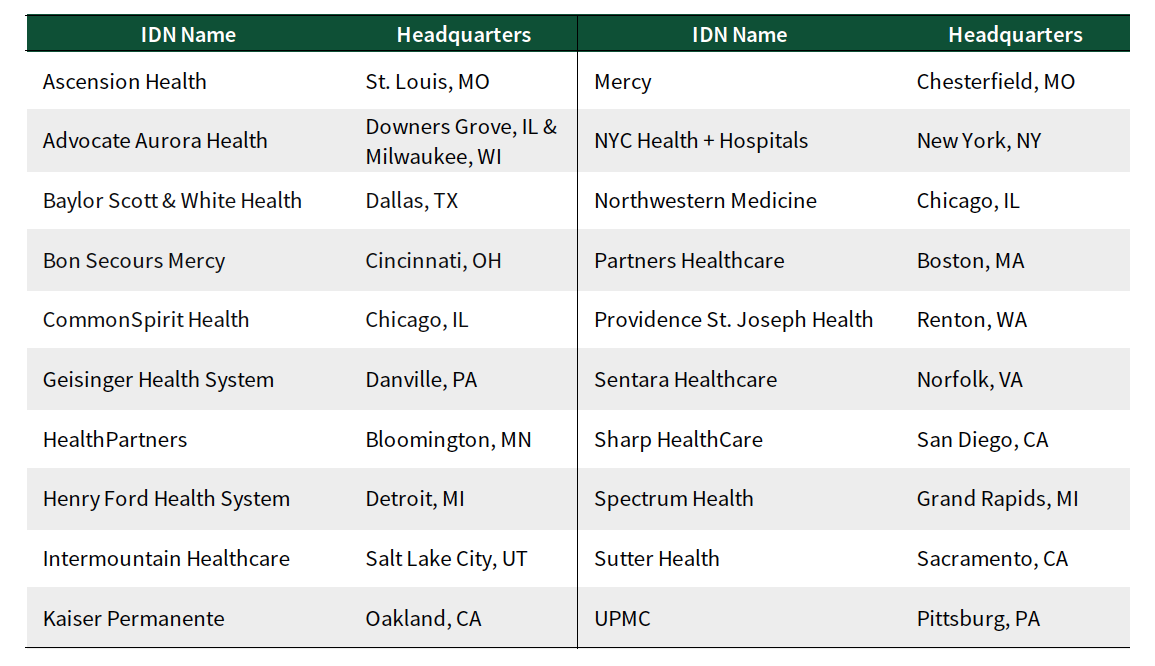

- What is the size (sites of care, patient volume, number of physicians and employees), financial performance, landscape of risk-bearing entities/activities, and pharmacy operations of 20 of the top IDNs?

- What is the notable recent market activity and specific strategic imperatives of 20 industry-leading IDNs?

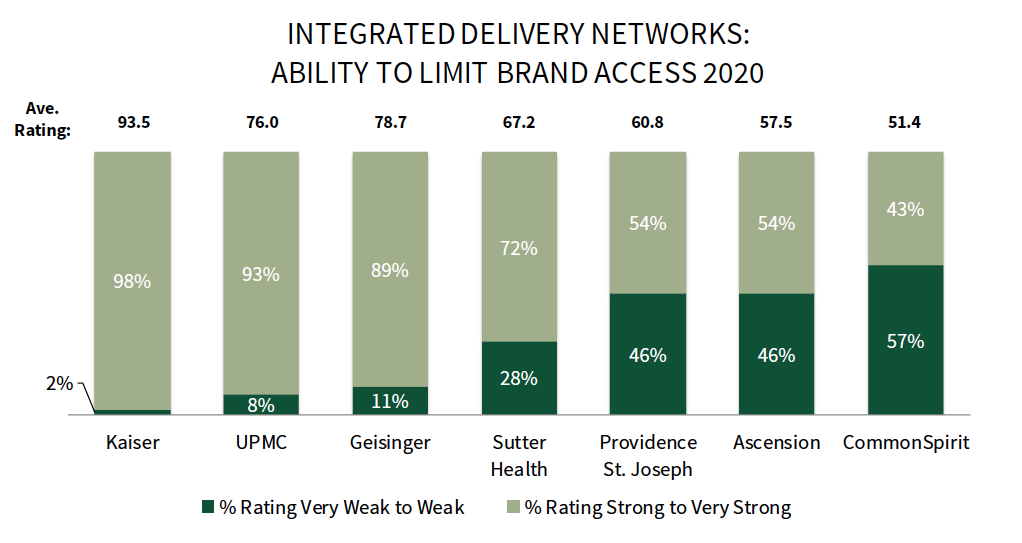

- Which integrated delivery networks are rated by manufacturers as most able to limit brand access, and why? Which integrated delivery networks are rated as most willing to partner with pharmaceutical firms?

Key Finding: Kaiser is rated by pharmaceutical manufacturers as strongest in its ability to limit brand access due to its high control over physician prescribing behavior and closed system; Geisinger is rated most willing to partner.

Access & Partnership Landscape Reveals Opportunities to Partner with High Access-Impacting IDNs. Respondents representing top mid-size, large, and very large pharmaceutical firms were asked to consider and rate six select industry-leading IDNs in their ability to limit brand access and willingness to partner. Kaiser is rated strongest in ability to limit access, followed by UPMC and Geisinger, due to these organizations' high level of control over prescribing and structures characterized by close integration of payer and provider.

UPMC and Geisinger, however, are also rated as most willing to partner on mutually beneficial initiatives. These organizations seek and/or show interest in discussions and are willing to consider innovative partnership ideas.

Top Integrated Delivery Network Accounts Profiled. IDN profiles provide key metrics useful for account teams and planning, such as IDN size metrics, status of risk-bearing activities/entities (e.g., IDN-owned health plan, ACO), pharmacy operations, and financial performance. Profiles also review recent notable market activity for key accounts and the organization's strategic imperatives. HIRC's selection of industry-leading IDNs is based upon a combination of overall size, captive health plan membership, and regional impact. In-depth profiles of the following organizations are provided:

Research Methodology and Report Availability. In January, HIRC surveyed 61 respondents representing 26 pharmaceutical firms. Online surveys were used to gather quantitative and qualitative information regarding the access and partnership landscape. Information for IDN profiles is derived by in-depth secondary research and IDN panelist surveys when possible. The full report, Profiles of Industry-leading IDNs and the Market Access & Partnership Landscape is part of the Organized Providers Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >