Pharmacy Benefit Managers: Specialty Medication Management and Contracting Trends

Highlights of the report:

Download a PDF of these Highlights

PBMs continue to seek solutions to better manage the specialty drug trend as their clients demand relief from rising costs. HIRC’s report, Pharmacy Benefit Managers: Specialty Medication Management and Contracting Trends, examines specialty drug distribution through PBMs, PBMs' specialty medication management and formulary tactics, and trends in contracting with manufacturers. The report addresses the following:

- What are PBMs most focused on in 2025 to better manage specialty drug costs?

- What is the status of national recommended formularies and exclusion lists offered by PBMs? What drug categories are most targeted for additional preferred products and/or exclusions in future years?

- What is the status of PBM biosimilars adoption and current and future goals for private-label biosimilar offerings?

- What is the status of PBMs' copay adjustment program offerings and medical benefit management/contracting services?

- What is the nature of the contracting environment between PBMs and drug manufacturers?

- Which manufacturers stand out as best in PBM engagement to support their specialty portfolios?

Key Finding: PBMs continue to leverage national recommended formularies and excluded product lists to gain better contracting value, most often targeting categories with biosimilars and other classes that have grown increasingly crowded.

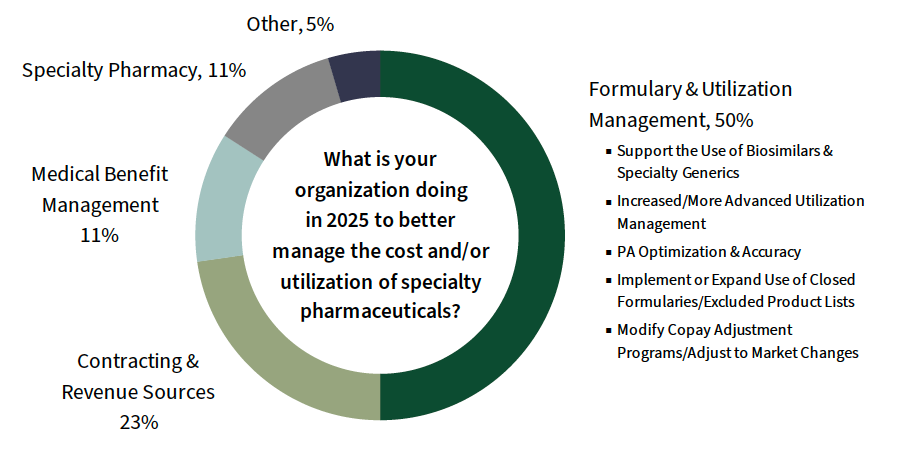

Formulary and Utilization Management Dominates PBMs' Strategies for Specialty Drug Cost Containment in 2025. PBMs were asked to consider their top activities of focus to better manage the specialty drug trend for clients in 2025. Half of PBMs’ responses center around formulary and utilization management, while another 23% of responses are focused on contracting and revenue sources. PBMs are looking to biosimilars to generate savings, citing biosimliars-forward formularies and private-label initiatives. Over half of PBM respondents also expect the number of specialty drug exclusions to increase going into 2026/2027.

The full report examines PBMs' management activities in detail, including the current status of copay adjustment programs and medical benefit management & contracting offerings.

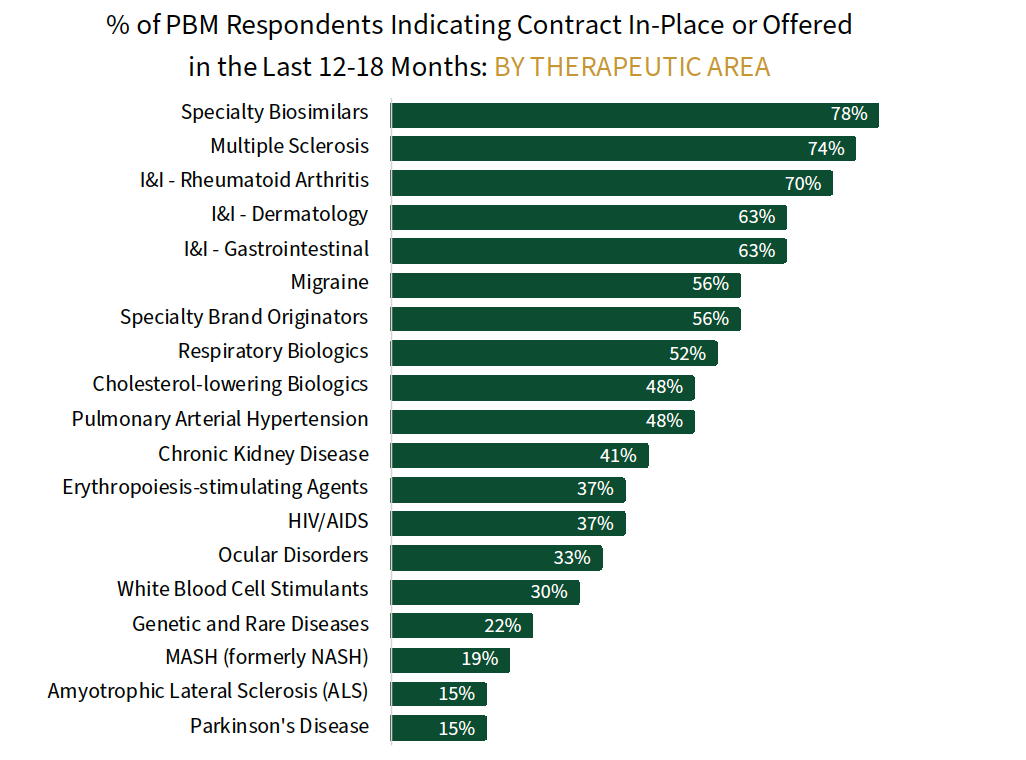

The Contracting Environment for Specialty Medications. PBM decision-makers report a competitive contracting environment for specialty medications, but contract prevalence and offerings vary by therapeutic class. More contracting is observed in crowded classes, or classes with biosimilars competition. Flat access rebates/discounts + price protection is the most common type of contract reported.

The full report examines contract types in-place/offered and the most common rebate/discount amounts across a listing of 19 specialty categories. PBMs' future expectations for fair and reasonable contract offerings from manufacturers to gain/maintain favorable market access are also reviewed.

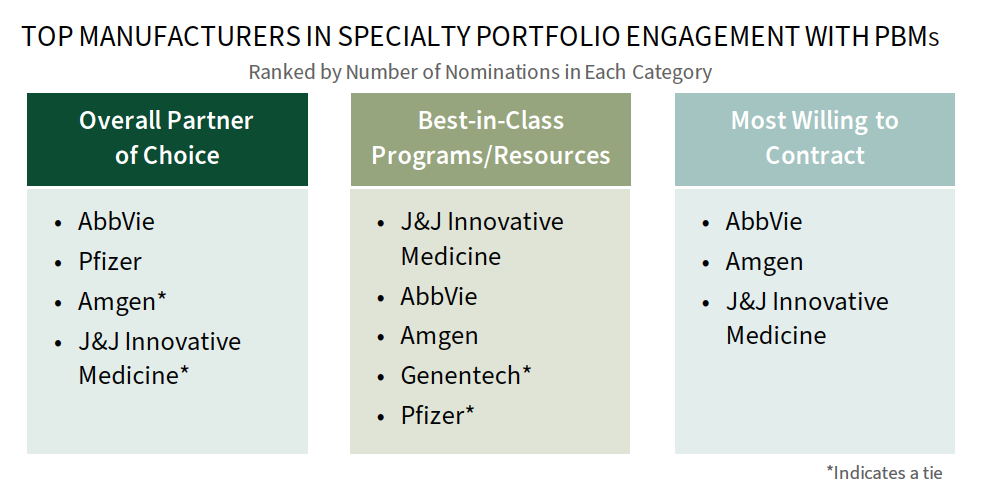

AbbVie Leads in Support of its Specialty Portfolio. PBM decision-makers were asked to nominate a manufacturer in three key areas: 1) Overall Partner of Choice in Specialty, 2) Best-in-Class Programs/Resources in Specialty, and 3) Most Willing to Contract. AbbVie is consistently among the leaders nominated in as best-in-class across categories, recognized for contracting for its robust portfolio, its exceptional account management personnel, and for understanding clients’ business model & needs.

The full report also provides benchmark ratings of 35+ specialty medication manufacturers in presence and willingness to contract with PBMs.

Research Methodology and Report Availability. In January & February 2025, HIRC surveyed 27 pharmacy benefit manager decision-makers representing 14 unique very large, mid-size, and small/upcoming PBMs. Online surveys and follow-up telephone interviews were used to gather information. The Pharmacy Benefit Managers: Specialty Medication Management and Contracting Trends report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >