ACOs: Specialty and Oncology Management Initiatives 2015-2018

Highlights of the report:

Download a PDF of these Highlights

As ACOs plan for additional risk responsibility in the coming years, strategies for managing the cost and quality of care associated with oncology and specialty conditions are emerging. HIRC’s report, ACOs: Specialty and Oncology Management Initiatives 2015-2018, examines trends in reimbursement, medication management, and quality initiatives across ten specialty therapeutic areas. The report addresses the following questions:

- How has the market landscape evolved in terms of specialty-specific accountable care initiatives? What is the level of specialist participation?

- What are the current trends in risk assumption, specialist reimbursement, and specialty medication management?

- How much are ACOs investing in the management of cancer and other specialty therapeutic areas? In which disease states have ACOs adopted quality metrics and clinical pathways?

- Which manufacturers are supporting ACOs in specialty and oncology? Which actionable opportunities exist for pharmaceutical firms?

Key Finding: ACOs continue to remain engaged in common chronic disease states; however, shifting payer incentives, quality metrics development, and increasing costs could further shift the focus towards specialty and oncology management by 2018.

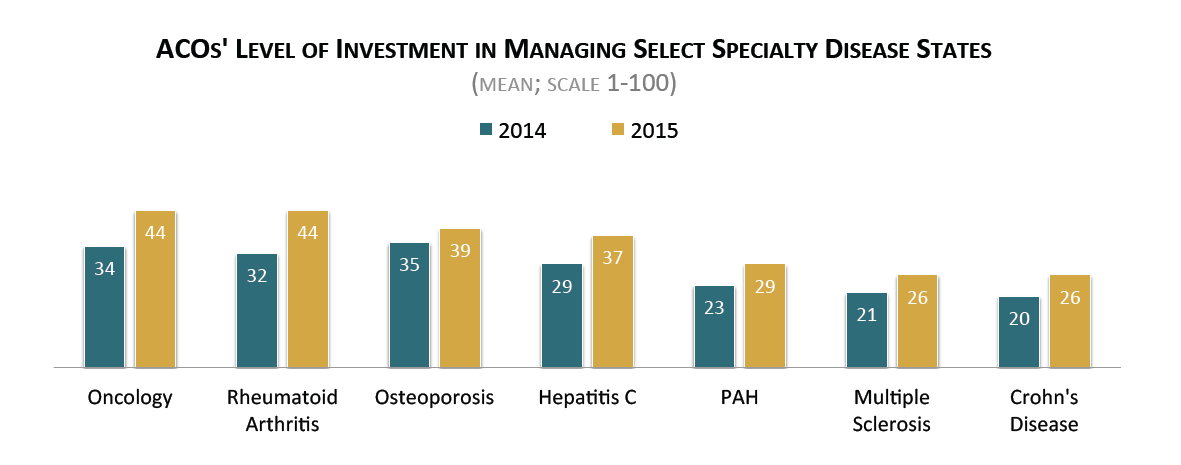

ACO Investment in Oncology and Specialty Management is Increasing Incrementally. While ACOs maintain an aggressive focus on patients with conditions such as diabetes, and cardiovascular diseases, they have modestly increased their focus in select specialty therapeutic areas. For example, on average, ACOs rated their level of investment in managing patients with cancer and rheumatoid arthritis about 33% higher in 2015.

Quality metrics are driving ACOs to focus on cancer screenings, while other activity includes care management and physician education around evidence-based protocols and the cost of therapy. The full report includes the status of quality metric adoption (current and projected) and clinical pathways adoption across ten specialty therapeutic areas.

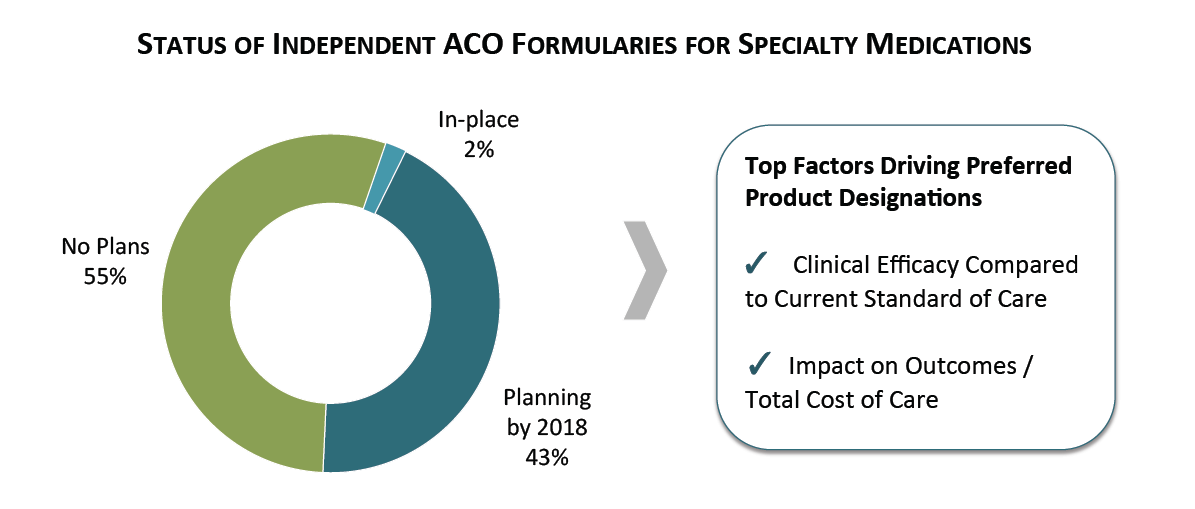

Over 40% of ACOs May Implement an Independent Formulary for Specialty Medications by 2018. Just over 40% of ACOs plan to implement a separate, independent formulary for specialty medications by 2018 as payer incentives evolve and as ACOs take on more risk. ACOs with commercial contracts in-place can be responsible for drug costs as part of total cost of care measures and CMS intends to incorporate accountability for Part D drug costs for its Next Generation ACOs by performance year 2 (2017). ACOs rate the product's efficacy and its impact on outcomes and total cost of care as the most important factors driving preferrend product designations.

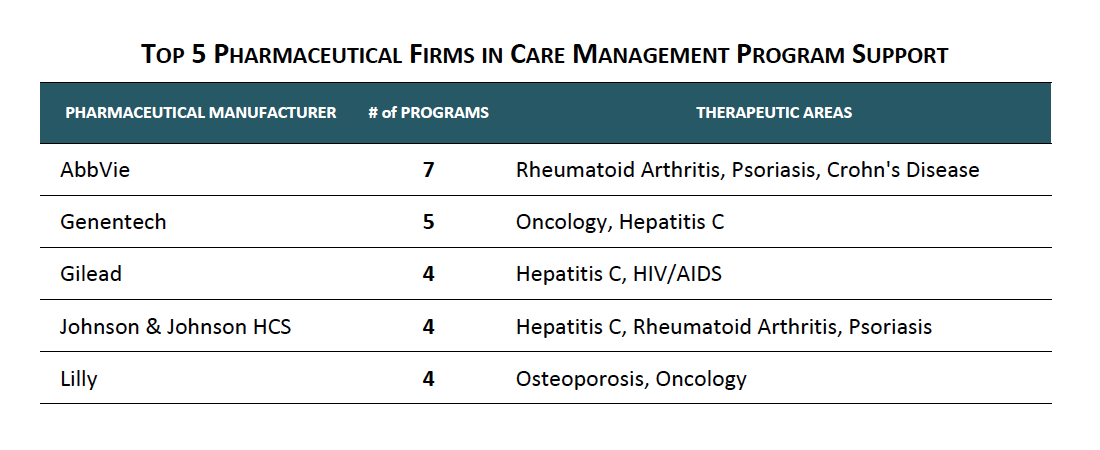

AbbVie Leads in Care Management Support for ACOs in Specialty Therapeutic Areas. While manufacturers have most often engaged ACOs in common chronic disease states, HIRC's sample reported a total of 34 specialty care management collaborations with pharmaceutical firms. AbbVie is well-regarded for its care management support in rheumatoid arthritis, psoriasis, and Crohn's disease while Genentech has engaged ACOs in oncology.

The full report includes benchmark ratings of the top 20 ACOs engaging the market segment, as well as areas for partnership that would be most impactful to ACOs' specialty-specific needs.

Research Methodology and Report Availability. In July, HIRC surveyed 47 ACO executives representing 2.4 million Medicare and commercial lives. Online surveys, follow-up telephone interviews, and in-depth secondary research were used to gather information. The ACOs: Specialty and Oncology Management Initiatives 2015-2018 report is part of the Managed Oncology Service, and is now available to subscribers at www.hirc.com/summary/mos.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >