Academic Institution & Health System-based Cancer Centers: Market Trends and Manufacturer Competitive Assessment

Highlights of the report:

Download a PDF of these Highlights

As Cancer Centers seek to maintain a focus on managing the total cost of cancer care in 2025, they continue to grapple with the high-cost and complex distribution logistics of novel therapies. HIRC's report, Academic Institution & Health System-based Cancer Centers: Market Trends and Manufacturer Competitive Assessment, reviews the market environment and strategic imperatives for Cancer Centers, and provides a competitive assessment of oncology medication manufacturers in Cancer Center engagement. The report addresses the following:

- What are Cancer Centers' top market concerns and strategic priorities in 2025?

- What is the status of Cancer Center activity related to oncology pharmacy and dispensing services (e.g., alternate site infusion, specialty pharmacy)?

- What is the status of oncology preferred drug lists, clinical pathways, and other utilization management tactics?

- What is the status of oncology biosimilar adoption among Cancer Centers?

- Which firms are most often nominated as Cancer Centers' partner of choice? Which firms are nominated as providing the best oncology-related support offerings?

- How do pharmaceutical firms benchmark in account engagement and quality of oncology account managers, medical/clinical science liaisons, and field-based reimbursement managers?

Key Finding: Cancer Centers' top strategic imperatives in 2025 are to increase patient referrals through enhanced partnerships with community practices, as well as expand access to bispecific therapies.

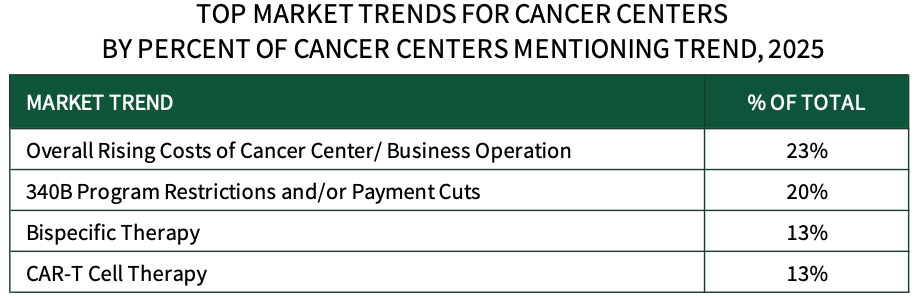

Top Market Trends for Cancer Centers in 2025. Cancer Center respondents identify a number of market trends with the potential to impact their organizations, including (1) Overall Rising Costs of Cancer Center/Business Operations, (2) 340B Program Restrictions/Payment Cuts, (3) Bispecific Therapies, and (4) CAR-T Cell Therapy.

The full report provides the complete listing of 50+ trends identified by Cancer Centers, as well as their top strategic imperatives for the next 12-18 months.

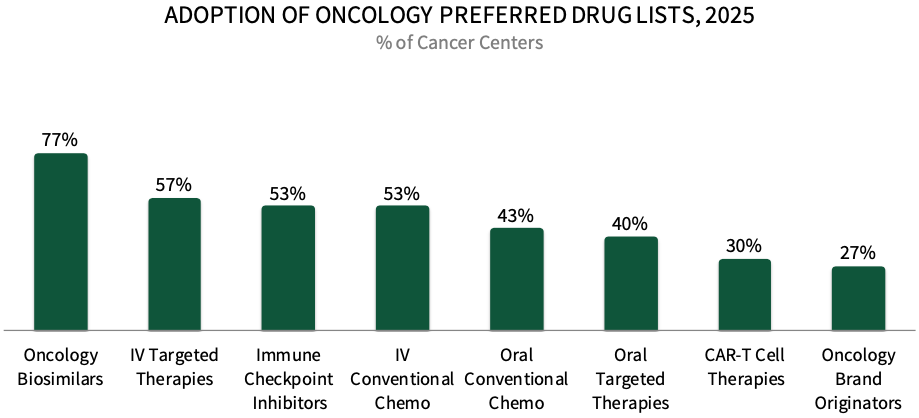

Cancer Centers Most Frequently Designate Preferred Products in Categories with Oncology Biosimilars. About 77% of respondents in HIRC's sample report having preferred oncology biosimilar products in place in 2025, followed by 57% with preferred IV targeted therapies, and 53% with preferred immune checkpoint inhibitors and IV conventional chemotherapies. The full report examines biosimilars in detail, including which are preferred and how Cancer Centers promote their use.

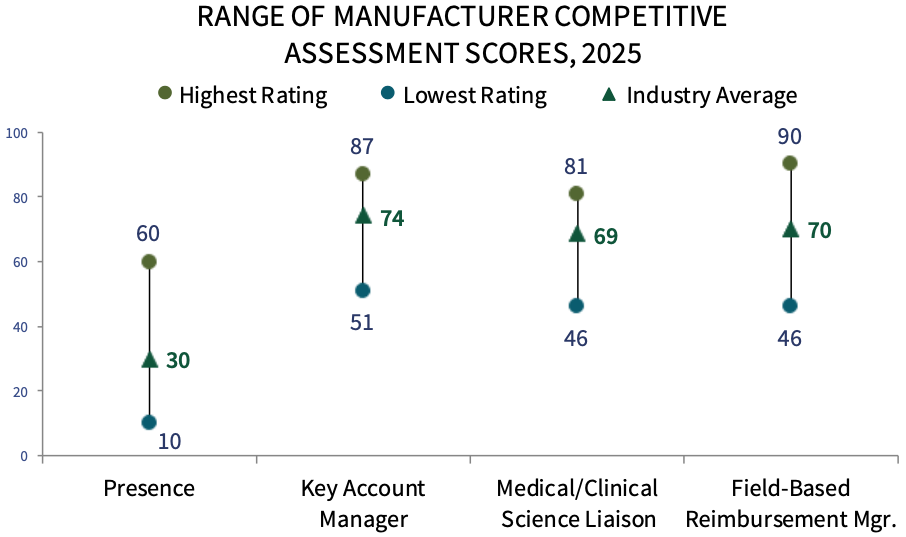

Pharmaceutical Manufacturer Competitive Assessment. Cancer Center respondents were asked to evaluate three types of manufacturer customer-facing personnel as noted below. Amgen, Pfizer Oncology, Genentech, AstraZeneca, and Bristol Myers Squibb rate highest in overall manufacturer field personnel engagement in 2025. The complete report provides Cancer Center executives' ratings of 30+ firms active in the oncology space, as well as ratings of manufacturer's oncology-related support offerings and nominations for overall partner of choice.

Research Methodology and Report Availability. In January HIRC surveyed 30 executives from Cancer Centers. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Academic Institution & Health System-based Cancer Centers: Market Trends and Manufacturer Competitive Assessment, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >