Medicare Advantage Plans: Operational Objectives in Oncology Management and Market Access Metrics

Highlights of the report:

Download a PDF of these Highlights

Medicare Advantage plans continue to apply a mix of medication management tactics to address rising oncology drug spend; the proposed changes to allow step therapy on Medicare Part B therapies are expected to accelerate this activity. HIRC's report, Medicare Advantage Plans: Operational Objectives in Oncology Management and Market Access Metrics, reviews Medicare Advantage plans' approaches to oncology management and examines the resulting market access landscape across ten cancer types. The report addresses the following:

- Which operational objectives drive Medicare Advantage plan decision-making in oncology medication management?

- What is the status of plans' utilization management tactics for oncology medications across benefits?

- What is the status of oncology clinical pathway adoption and development across ten cancer types?

- What are plans' rationale for selecting oral and IV oncology agents? How do plans promote the use of preferred products?

Key Finding: While MA plans continue to apply a variety of tactics to manage oncology medications, provider-related issues such as pathway participation and adherence remain a challenge.

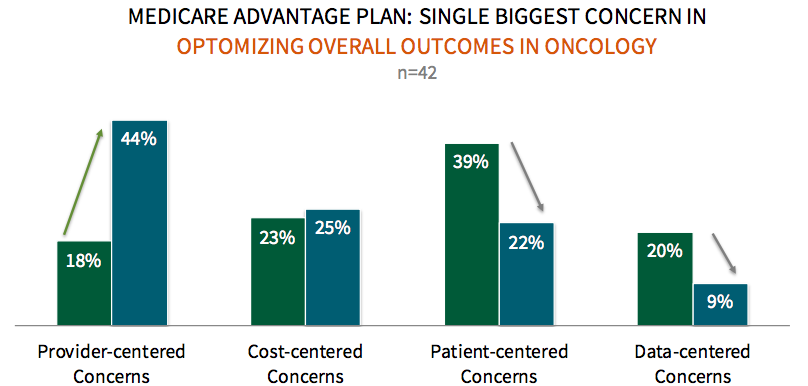

MA Plans' Concerns Around Provider-Centric Issues Related to Oncology Management are Rising. Medicare Advantage key decision-makers were asked to provide the plan's single biggest concern when it comes to optimizing outcomes in oncology. Medicare Advantage plans report their single biggest concern as provider-centric issues (e.g., practice variation, clinical pathway adherence, etc.), rising from just 18% of plans in 2017 to over 40% in 2018.

The full report includes the complete listing of 15 higher order categories within the four thematic categories of concerns related to optimizing outcomes in oncology.

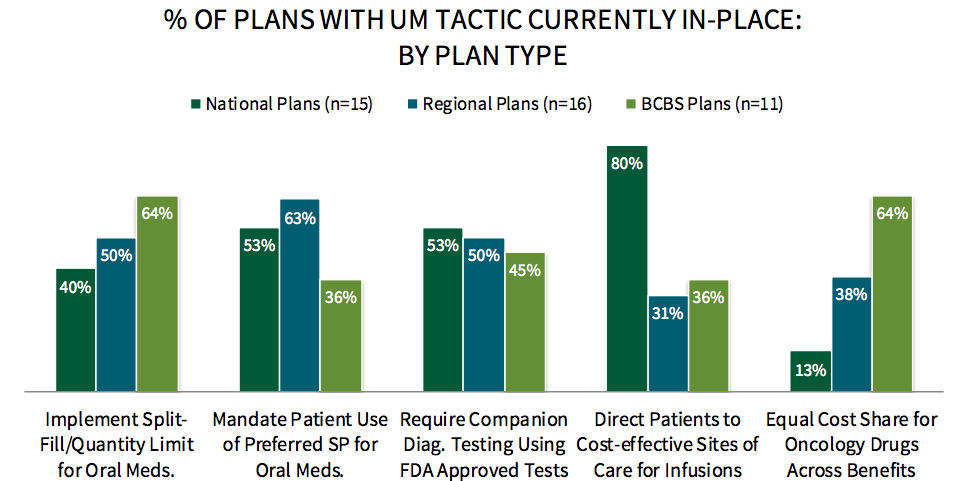

Approaches to Oncology Medication Utilization Management Vary by Plan Type. Respondents were asked to indicate the status of utilization management tactics in-place to manage oncology medications across benefits. About 80% of respondents from national plans (12 of 15) report directing patients to the most cost-effective sites of care for oncology infusions, compared to only 16% of regional plans, and 36% of BCBS plans reporting use of the tactic to manage oncology medications across benefits.

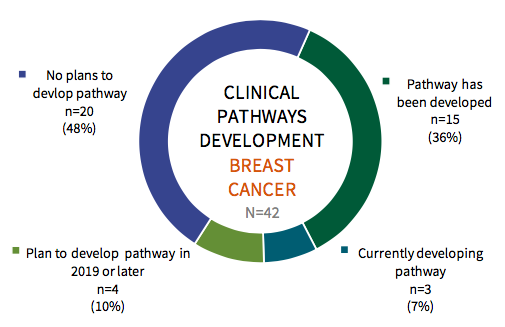

Clinical Pathway Activity is Highest in Breast Cancer Among Medicare Advantage Plans in 2018. Medicare Advantage plan respondents were asked to indicate the status of the plan's clinical pathway adoption across ten cancer types. In breast cancer, 35% of respondents report having a pathway in-place in 2018. Approaches to pathway development vary, however nearly 75% of plans with pathways in-place developed their pathways internally, with the remainder partnering with an external vendor.

Research Methodology and Report Availability. In August, HIRC surveyed 42 pharmacy and medical directors from national, regional, and BCBS plans representing 7.8 million Medicare Advantage lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicare Advantage Plans: Operational Objectives in Oncology Management and Market Access, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >