Oncology Medication Distribution: Manufacturer Account Engagement and Competitive Issues

Highlights of the report:

Download a PDF of these Highlights

As consolidation in the oncology distribution and provider segments continues, it is critical for manufacturers to continually evaluate distribution channel strategies to achieve optimal market access. HIRC's report, Oncology Medication Distribution Channel: Manufacturer Engagement, Support, and Competitive Issues, provides benchmark ratings of pharmaceutical firms and perspectives on collaborations from specialty pharmacy providers (SPPs) and oncology GPOs. The report addresses the following questions:

- Which manufacturers are most often nominated by channel executives as overall "Partner of Choice" in oncology?

- How do specialty pharmacy providers (SPPs) rate pharmaceutical manufacturers in account management support, quality of value-added resources, and willingness to contract?

- What are specialty pharmacy provider perceptions of the contracting environment for oral and IV oncology medications?

- What are oncology GPOs' key challenges in supporting their customers and what actionable opportunities exist for manufacturers?

Key Finding: Competition in the oncology medication distribution segment is intensifying as more pharmaceutical firms bring innovative therapies to market. Manufacturers are looking to collaborations to maximize channel strategies and access.

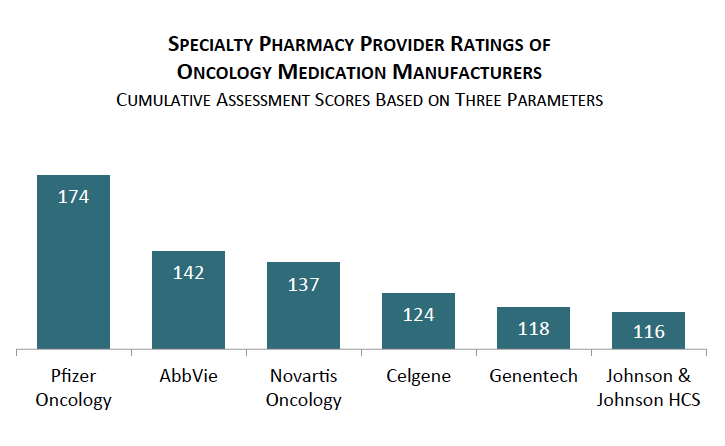

Pfizer Oncology, AbbVie, and Novartis Oncology are Rated Highest by Specialty Pharmacy Providers in Cancer. Pfizer Oncology, AbbVie, and Novartis Oncology earned the highest ratings from specialty pharmacy executives in supporting their oncology brands through account management support, quality of value-added resources, and willingness to contract.

The full report provides benchmark ratings for 22 oncology medication manufacturers as well as SPPs' and oncology GPOs' nominations for overall "Partner of Choice."

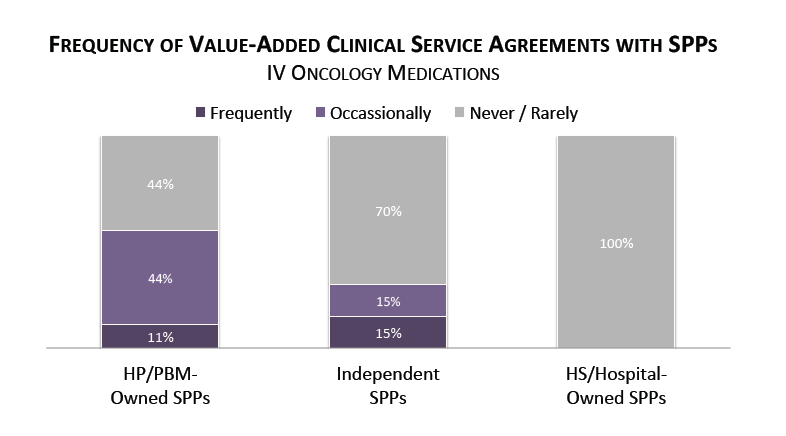

Manufacturers' Willingness to Contract with SPPs for Value-added Clinical Services in Oncology Varies. Specialty pharmacy provider respondents were asked to rate how often pharmaceutical manufacturers were willing to contract for value-added clinical services for oncology medications at an additional cost or fee-for-service basis. For IV oncology medications, manufacturers are most likely to contract with PBM/HP-owned specialty pharmacies for such services, followed by independent SPPs.

The full report provides value-added clinical service contracting in oral oncology as well as the prevalance of performance-based contracting approaches in oral and IV oncology.

Mandatory Specialty Pharmacy is the Primary Challenge to the Viability of Oral Oncolytic In-Office Dispensing. Oncology GPOs report that their mid-sized and large oncology group customers are best positioned to make in-office dispensing of oral oncology medications a viable service line due to a multitude of challenges. Respondents unanimously identified health plans' mandatory specialty pharmacy requirements as the most difficult challenge to in-office dispensing, followed by the complexity of the reimbursement process.

The full report examines additional market dynamics impacting the community oncology practice segment as observed by oncology GPOs, such as preferred drug list development.

Research Methodology and Report Availability. In August, HIRC surveyed 38 specialty pharmacy executives representing independent, health plan-owned, PBM-owned, and health system/hospital-owned SPPs, and three oncology GPO/specialty distributor executives. Follow-up telephone interviews with select panelists were also used to gather information. The full report, Oncology Medication Distribution Channel: Manufacturer Engagement, Support, and Competitive Issues, is part of the Managed Oncology Service, and is now available to subscribers at www.hirc.com/summary/mos.

Download a PDF of these Highlights