Commercial Health Plans: Operational Objectives in Oncology Management and Market Access Metrics

Highlights of the report:

Download a PDF of these Highlights

As the number of new, costly oncology agents entering the market continues to rise, commercial health plans strive to ensure appropriate utilization of the most cost-effective treatments for patients. HIRC's report, Commercial Health Plans: Operational Objectives in Oncology Management and Market Access Metrics, reviews commercial plans' approaches to oncology management and examines the resulting market access landscape across thirteen cancer types. The report addresses the following:

- Which operational objectives and strategic priorities drive health plan decision-making in oncology medication management?

- What is the status of payers' utilization management tactics for oncology medications across benefits?

- What is the status of oncology preferred drug lists (PDL) and clinical pathway adoption and development across thirteen cancer types?

- What is the rationale for selecting preferred oral and IV oncology medications? What are the methods used to promote preferred products across thirteen cancer types?

Key Finding: Commercial health plan leadership report the high cost of newly launched oncology medications as the number one disruptive market trend in 2019, followed by new oncology biosimilars, and the overall increasing cost of oncology medications.

Payers Report Tighter PA Requirements for Oncology Medications as Their Top Strategic Imperative in 2019. Commercial pharmacy and medical directors were asked to provide the plan's top three strategic imperatives/priorities in 2019. Payers report tighter prior authorization requirements/criteria for oncology medications as the top strategic imperative, followed by driving oncology biosimilar uptake, and developing/improving oncology clinical pathways.

The full report provides a complete list of plan's top strategic imperatives, operational objectives, and disruptive market trends in 2019.

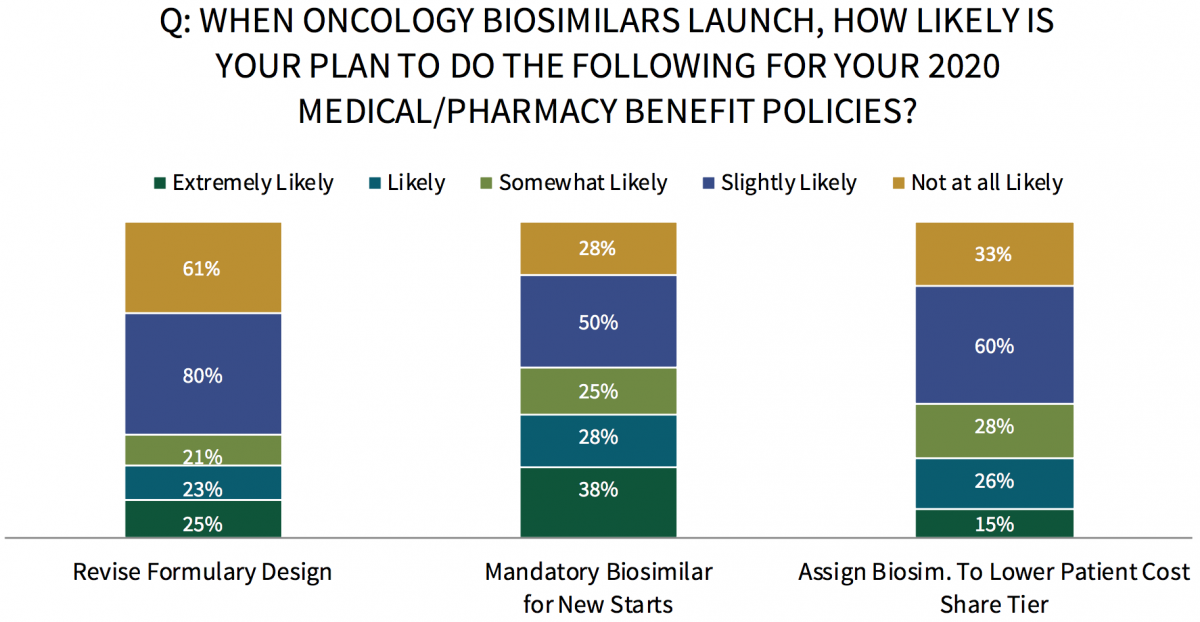

Commercial Health Plans are Most Likely to Revise Formulary Design Upon Oncology Biosimilar Launches. Respondents were asked to indicate the likelihood of several medical and pharmacy benefit policy changes upon the launch of oncology biosimilar medications in late 2019. Commercial health plan panelists report they are most likely to revise their formulary design when oncology biosimilars become available, followed by implementing mandatory biosimilar(s) for new starts, and assigning biosimilars to a lower patient cost share tier and/or revising tier structure.

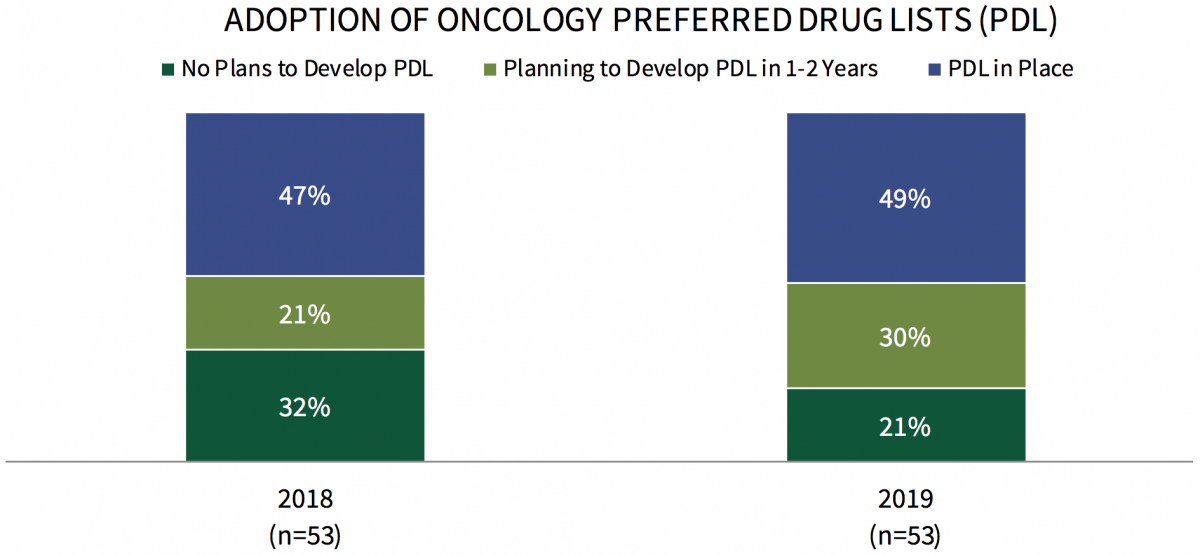

Commercial Health Plans Reporting Use of Oncology Preferred Drug Lists (PDLs) Continues to Rise. The number of commercial health plans with preferred drug lists in-place for oral and/or IV products in oncology increased from 47% of plans in 2018 to 49% of plans in 2019. However, PDL activity varies greatly by cancer type and medication type, with plans most likely to have preferred oral oncology agents in prostate cancer and chronic myeloid leukemia (CML).

Research Methodology and Report Availability. In May, HIRC surveyed 53 pharmacy and medical directors from national, regional, and BCBS plans representing 84 million lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Operational Objectives in Oncology Management and Market Access Metrics, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >