Commercial Health Plans: Oncology Medication Management and Market Access

Highlights of the report:

Download a PDF of these Highlights

As the cost and utilization of cancer medications continues to increase, commercial health plans are adopting more aggressive strategies to manage the oncology space. HIRC's report, Commercial Health Plans: Oncology Medication Management and Market Access, reviews plans' approaches to oncology management and examines the resulting market access landscape. The report addresses the following questions:

- What key oncology-related market trends are commercial health plans currently monitoring?

- What is the status of payers' utilization management tactics across oncology medication types (e.g., targeted therapies, checkpoint inhibitors, biosimilars, CAR-T)?

- What is the status of oncology preferred drug lists (PDL), exclusion lists, and clinical pathway adoption across cancer types?

- How are plans managing oncology medication distribution (e.g., preferred specialty pharmacy, white bagging, site of care management)?

Key Finding: Tighter PA requirements/criteria, site of care management for infusions, and driving the uptake of biosimilars & generics are the most common activities used by health plans to manage cost and utilization of oncology medications.

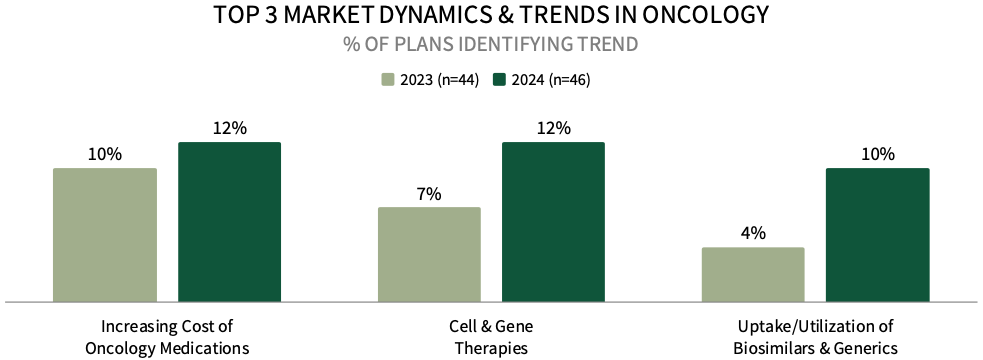

Increasing Cost of Oncology Medications Among Top Market Trends for Commercial Health Plan Leadership. Commercial health plan decision-makers were asked to identify the top oncology-related market trends impacting their business. The top trend identified is the increasing cost of oncology medications, followed by cell & gene therapies, and uptake/utilization of biosimilars and generics. A greater percentage of plans mentioned these trends in 2024, compared to 2023.

The complete report examines the full listing of 23 market trends identified by health plan leadership.

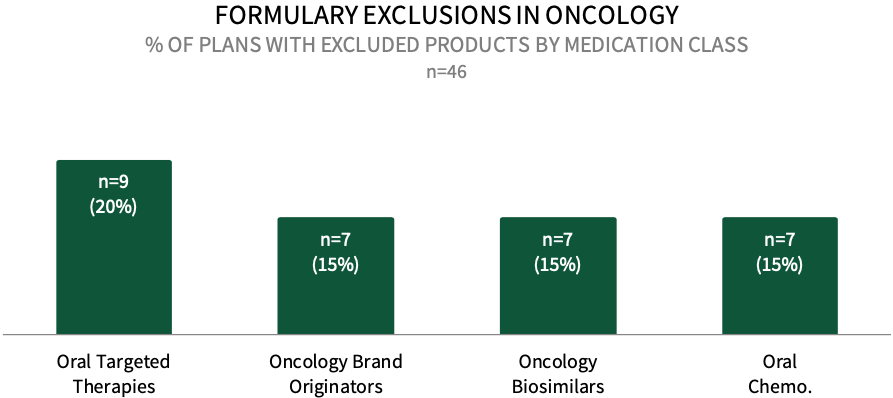

Formulary Exclusions in Oncology. While the prevalence of formulary exclusions in oncology remains low, about 20% of respondents in HIRC's commercial health plan sample indicate that their plan currently has formulary exclusions across oral targeted cancer therapies, followed by 15% with exclusions across oncology brand originators, oncology biosimilars, and oral conventional chemotherapy medications. The full report examines formulary exclusions across eight oncology treatment/therapeutic categories.

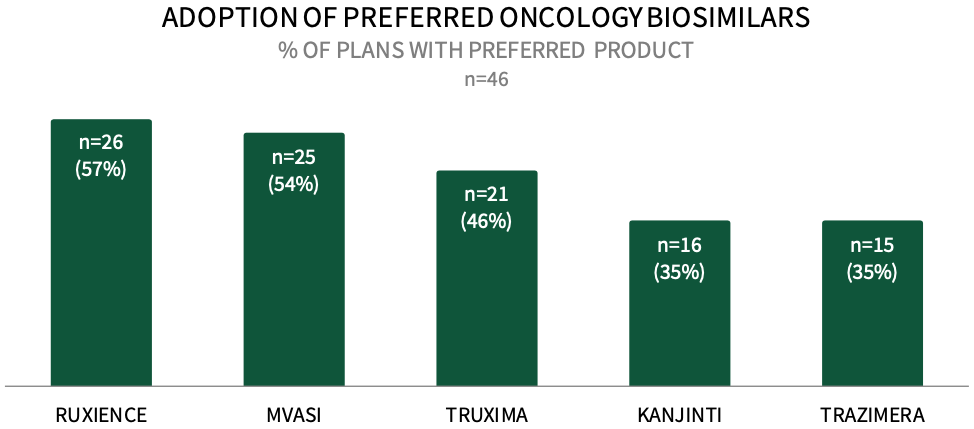

Commercial Payers are Actively Preferring Oncology Biosimilars in 2024. About 57% of respondents in HIRC's sample report that their plan designates RUXIENCE as a preferred biosimilar for their commercial population in 2024, followed by 54% preferring MVASI, 46% preferring TRUXIMA, and 35% preferring KANJINTI and TRAZIMERA. The full report examines the status of uptake across 12 oncology biosimilars and the utilization management tactics used to promote the use of plans' preferred biosimilars.

Research Methodology and Report Availability. In June 2024, HIRC surveyed 46 pharmacy and medical directors from national, regional, and BCBS plans representing 49 million commercial lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Commercial Health Plans: Oncology Medication Management and Market Access, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >